The Ultimate Guide to Understanding and Predicting Customer Churn

Customer churn is an inevitable part of running your business. Managing your customer churn rates, or customer turnover, is critically important. In this article, we help you analyze your customer churn rates, mitigate churn and maximize customer retention.

What is Customer Churn?

Customer churn refers to the moment where your customers stop using your company’s products or services. When a customer leaves your business, this leads to a loss in revenue. When you have a high customer churn rate, this could make you panic, as it leads to significant revenue loss and decreased market share. Your customer churn rate is typically calculated by dividing the number of customers lost during a specific time period by the total number of customers at the beginning of that period. For example, if your business starts a month with 1,000 customers and loses 50 customers by the end of the month, the churn rate would be 5% (50 divided by 1,000). This rate measures the percentage of customers who stop using your company’s products or services within a given time period. The calculation may vary slightly depending on your business model and industry, but the core concept remains the same: quantifying the proportion of customers who leave relative to the total customer base. Understanding and managing your customer churn is essential for maintaining a healthy customer base and ensuring long-term business success. A decrease in customer count leads to less money in your business’ bank account.

Types of Customer Churn

Customer churn can be categorized into two main types:

- Voluntary churn: Voluntary churn occurs when your customers actively decide to stop buying from you. Your customers may be dissatisfied, experienced a change in personal circumstances, or have found an alternative. These could be considered lost customers.

- Involuntary customer churn: Involuntary churn happens when your customers are forced to stop using your service as a result of factors beyond their control, such as payment failures, expired credit cards, or technical issues. Involuntary churn can often be resolved internally or with relatively simple fixes. Nonetheless, it’s important to monitor your involuntary churn numbers as these could be symptomatic of a larger problem.

Measuring Customer Churn

There are some key metrics you need to know about so you can know your customer churn rate. Your customer churn rate measures the percentage of customers who stop using your company’s products or services within a specific time period. Your customer churn rate is calculated by dividing the number of customers lost during a certain period by the total number of customers at the beginning of that period. Conversely, your customer retention rates measure the percentage of customers who continue to use your business’ products or services over time. High customer retention rates indicate strong customer loyalty and satisfaction.

How Does Customer Churn Affect Your Business?

Customer churn can have profound and far-reaching consequences for any business. The most immediate effect is seen in a significant decrease in revenue, as each lost customer represents a direct reduction in income. This revenue loss can be particularly damaging for businesses with recurring revenue models, such as subscription-based services or SaaS companies, where customer lifetime value is an important metric. The financial effects of a decreasing customer count, however, extends beyond immediate revenue loss. As your business loses customers, you’ll find yourself allocating more resources to acquire new ones, leading to higher customer acquisition costs. This increased spending on marketing and sales efforts can strain budgets and reduce overall profitability. Additionally, customer churn negatively affects your average customer lifetime value, a key indicator of your company’s long-term financial health and growth potential. A high churn rate can significantly damage a company’s brand reputation, as dissatisfied customers may share their negative experiences with others, potentially deterring prospective customers. This negative word-of-mouth can create a ripple effect, making it increasingly difficult for your business to attract new customers and retain existing ones.

Sectors with High Customer Churn

Subscription-based businesses, such as streaming services or meal kit delivery companies, often face higher churn risks due to the ease with which customers can cancel their subscriptions. Similarly, SaaS companies, which rely on recurring revenue from software subscriptions, must constantly work to demonstrate value and prevent customer attrition. The telecommunications industry is another sector heavily affected by churn, with fierce competition and frequent promotional offers making it easy for customers to switch providers. Financial services, including banking and insurance, also face significant churn challenges owing to the long-term nature of customer relationships and the high costs associated with acquiring new clients. Across these sectors, the effect of customer churn is amplified due to the nature of their business models and the competitive landscape. For example, in the telecommunications sector, the loss of a customer often means not just the loss of current revenue but also the potential for future upsells and cross-sells. In financial services, losing a customer can mean forfeiting the opportunity to provide additional services over the customer’s lifetime, such as mortgages, investments, or insurance products. That’s why it’s important to fully understand your customer churn rate, so you can implement effective customer retention strategies to keep your loyal customers, maintain your customer base, and continue to grow.

How to Reduce Customer Churn

As a business owner, you want to keep your loyal customers happy, and grow your customer base. Customer churn is, however, an inevitable part of running a business. There are, however, key ways to prevent active churn, involuntary churn, and revenue churn. Here are some ways you mitigate customer churn:

- Enhance your customer experience: Empower your customer success team to always provide excellent customer service. Improving your customer service, whether by introducing a live chat function, or simply acting quickly to resolve poor customer service issues can help your business manage customer churn. The more you address your customers’ pain points, the happier your current customers will be.

- Implement customer feedback mechanisms: One of the best ways to find out how to improve your business, is to ask your customers. Regularly collecting and acting on customer feedback helps identify your areas for improvement and shows your customers that their opinions are valued. Good customer feedback mechanisms enable you to better understand your customers, and quickly resolve any poor customer service concerns. Robust feedback also helps you improve your customer service, enabling your teams to ensure excellent customer service.

- Develop strong customer success programs: Your customer success teams play a key role in ensuring your customers derive maximum value from products or services. Your customer success teams are directly linked to ensuring your business enjoys increasing loyalty and a lower churn rate.

- Personalize your customer interactions: Consider adding a personalized note to your next package. Tailoring your communications and offerings to your individual customer needs can significantly improve your customer satisfaction and customer retention.

- Offer proactive customer support: Anticipating and addressing customer issues before they escalate can prevent churn and build trust with your customers.

The Role of Technology in Churn Prevention

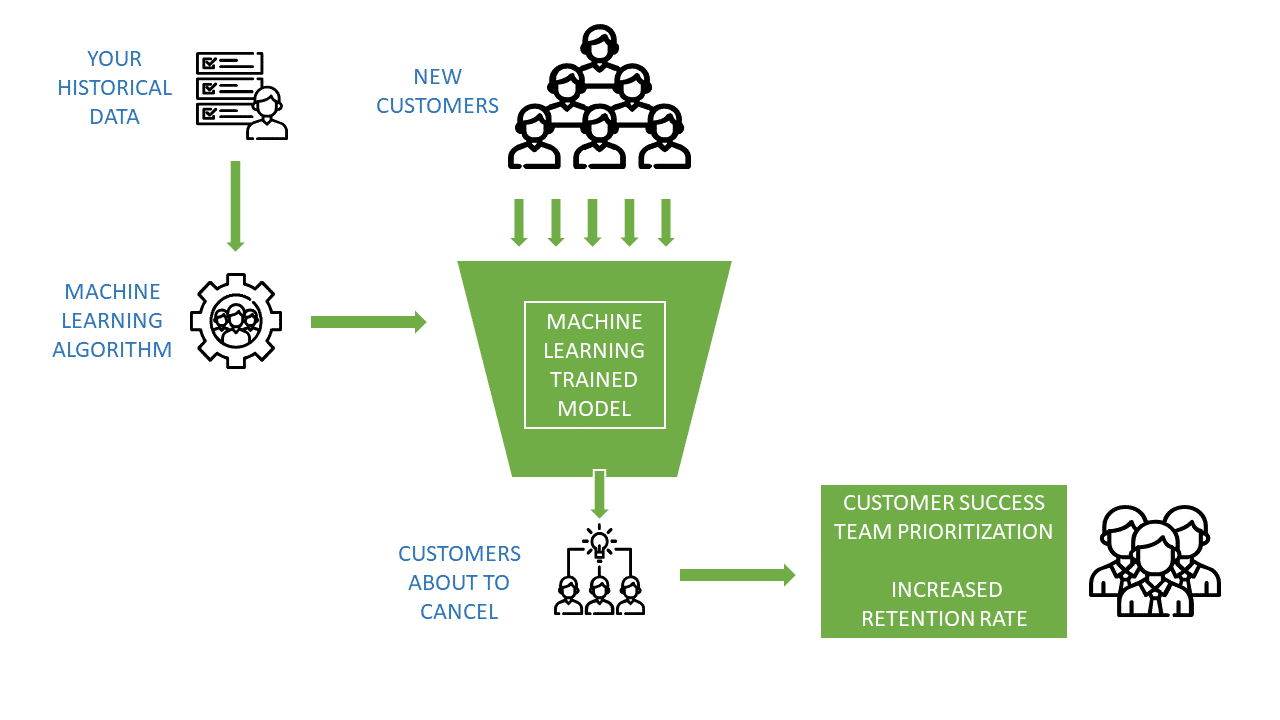

Advanced technologies, such as artificial intelligence and machine learning, can help your business predict and prevent customer churn. These tools can analyze vast amounts of customer data to identify patterns and early warning signs of potential churn. Using the right technologies to undertake your customer churn analysis involves examining historical data to understand why customers leave and identify factors that contribute to churn. Your churn analysis can help your business develop targeted customer retention strategies.

Understanding Churn Prediction

The Basics of Churn Prediction and Its Significance

Churn prediction is the process of identifying customers who are likely to cancel their subscriptions or stop using your products or services. Churn prediction analyzes various factors and patterns to identify the early warning signs of churn. The significance of churn prediction cannot be understated. Effective churn analysis helps you proactively identify and engage with at-risk customers, so you can take necessary actions to retain them and minimize revenue loss.

Key Factors for Predicting Customer Churn

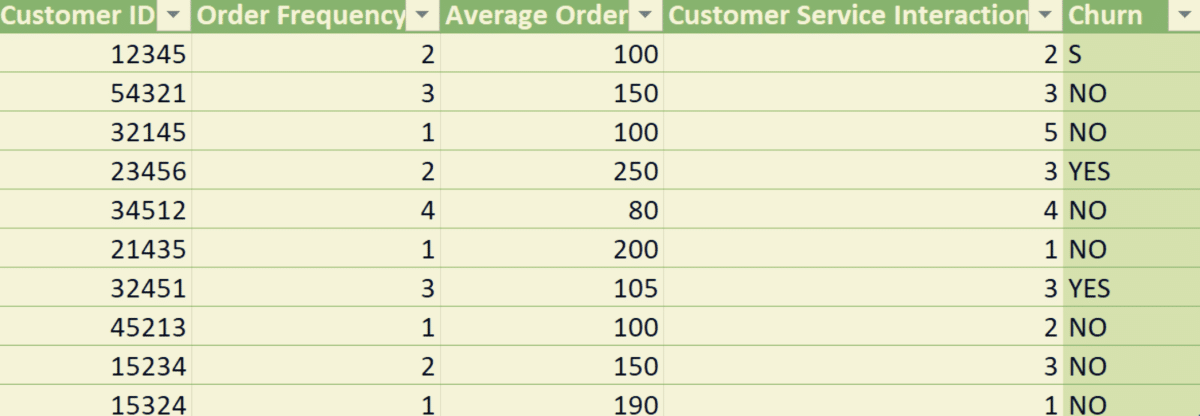

When it comes to churn prediction, you need to consider a wide range of factors from across your base of total customers. These factors can include customer demographics, purchase history, usage patterns, and customer interactions. Analyzing these factors, you can gain valuable insights into customer behavior and make informed decisions to reduce churn. Churn prediction also helps you understand the underlying reasons behind customer churn. Analyzing the patterns and trends associated with churn, you can uncover common pain points or issues that lead to customer dissatisfaction. You can use this knowledge to improve products, services, and your overall customer experience. Customer churn is influenced by a complex interplay of factors that can significantly affect. your company’s ability to retain its customer base.

Poor customer service is often at the forefront of these issues, as it can quickly erode trust and loyalty. Customer behavior can tell you so much about your churn rate. Analyzing how customers interact with your products and services, you can identify patterns that indicate potential churn. For example, a sudden decrease in usage or a decline in engagement can be early warning signs of customer dissatisfaction. When customers feel undervalued or frustrated by their interactions with a company, they are more likely to seek alternatives. This problem is closely tied to inadequate customer experience, which encompasses the entire journey a customer has with a brand. If this experience fails to meet expectations, or lacks consistency across touchpoints, it can lead to dissatisfaction and eventual churn. For example, if your social media posts talk about your business’ commitment towards answering customer queries within 12 hours, and that’s the experience new subscribers have, this could lead to dissatisfaction and new customers losing interest in your business.

Lack of customer satisfaction is a critical driver of churn, often resulting from a combination of factors including product quality, pricing, and overall value perception. When your customers don’t feel they’re getting sufficient value for their investment, they become prime candidates for churn. Customer satisfaction levels play a key role in churn prediction. Measuring customer satisfaction through surveys, feedback, or sentiment analysis, can help you identify dissatisfied customers who are more likely to churn. Addressing their concerns and improving their experience can help you retain these customers and reduce churn.

Ineffective customer success strategies also play a significant role. These strategies are designed to help your customers achieve their desired outcomes with your product or service. When they fall short, your customers may fail to see the long-term benefits of staying with your company.

High customer acquisition costs can indirectly contribute to churn by putting pressure on your business to recover these costs quickly, potentially leading to aggressive upselling or a reduced focus on retention efforts. This short-term thinking can alienate customers and increase the likelihood of churn. Of course, we must also consider competitive market pressures as an ever-present factor in customer churn. In industries with low switching costs and numerous alternatives, your customers may be easily tempted by competitors offering better deals, innovative features, or superior service.

To effectively fight against churn, your business must address these factors holistically, focusing on delivering exceptional service, creating seamless customer experiences, ensuring high satisfaction levels, implementing robust customer success programs, balancing acquisition and retention efforts, and continuously innovating to stay ahead of market pressures.

Engagement metrics, such as click-through rates, time spent on a website, or frequency of interactions, can also provide valuable insights into your customer churn. Monitoring these metrics, you can identify customers who are becoming less engaged and take steps to re-engage them before they churn.

These factors can vary from industry to industry, but common ones include customer behavior, engagement metrics, and customer satisfaction levels. By understanding these factors, your business can develop predictive models that help anticipate churn and take proactive measures.

Overcoming Challenges in Customer Churn Prediction

Predicting customer churn is not without its challenges. One of the main challenges your business may face is the availability and quality of data. Obtaining accurate and comprehensive data about customer behavior and engagement can be quite complex. Interpreting and analyzing this data can be time-consuming and demanding too. You do need to be able to overcome this key challenge, and one way to address these challenges is by leveraging advanced Business Intelligence (BI) tools. BI tools can enhance the accuracy and efficiency of churn prediction models by providing your business with actionable insights from large datasets. They enable your business to identify patterns, detect anomalies, and make data-driven decisions in a more efficient manner.

Another challenge in churn prediction is the dynamic nature of customer behavior. Customer preferences and needs can change over time, making it essential for your business to continually update and refine your churn prediction models. You need to regularly analyze and adapt to changing customer behavior, so you can stay ahead of churn and retain more customers.

There are other external factors you need to consider in relation to your customers, your growth rate, and your average churn rate. Economic conditions, industry trends, and competitor actions can all influence customer behavior and churn rates. You need to closely monitor these external factors and incorporate them into your churn prediction models. This way, you’ll gain a more comprehensive understanding of your customer churn.

Maximizing Customer Retention During Market Turbulence

Strategies for Identifying and Retaining At-Risk Accounts

During market turbulence, retaining your customers becomes even more critical. You need effective strategies that help you identify and retain at-risk accounts to ensure a steady revenue stream. Here’s how:

- Monitor your customer behavior and engagement: Track key metrics like your customer’s usage frequency, product adoption rate, and customer feedback. Use data analytics tools to gain insights into your customer preferences and needs. Analyze patterns and trends to identify potential churn risks.

- Establish strong personalized relationships: Build trust and rapport through regular communication and personalized interactions. Be sure to provide exceptional customer service to make your customers feel valued and understood. Build a sense of loyalty that is difficult to break.

- Proactively offer tailored solutions: Undertake customer satisfaction surveys and organize focus groups. Consider asking top customers to have one-on-one meetings with you so you can better understand their needs. Actively listen to customer feedback and take prompt action to address your customers’ concerns.

- Use technology for your customer retention: Implement a Customer Relationship Management (CRM) system, and use this to track your customer interactions, manage follow-ups, and ensure timely issue resolution. This also helps you to centralize customer data to give you a holistic view of each account, and business as a whole.

- Adopt data-driven marketing strategies: Create targeted marketing campaigns addressing the specific needs of your at-risk customers. Send personalized emails, offer exclusive discounts, and provide relevant content. Tailor your marketing efforts to individual preferences to increase engagement.

- Adopt a proactive, customer-centric approach: Prioritize your customer satisfaction and loyalty at every turn. Combine all your marketing strategies to navigate market turbulence confidently. Maintain a strong and sustainable customer base through comprehensive retention efforts.

Leveraging BI Tools for Churn Prediction and Prevention

How Business Intelligence Tools Enhance Churn Prediction

Business Intelligence tools play a vital role in enhancing churn prediction and prevention. These tools enable your business to gather, analyze, and visualize data in a user-friendly and intuitive manner. Using BI tools, you can gain a deeper understanding of customer behavior, identify patterns, and proactively address potential churn risks. With these insights, you can optimize your customer retention strategies, improve customer satisfaction, and increase customer lifetime value.

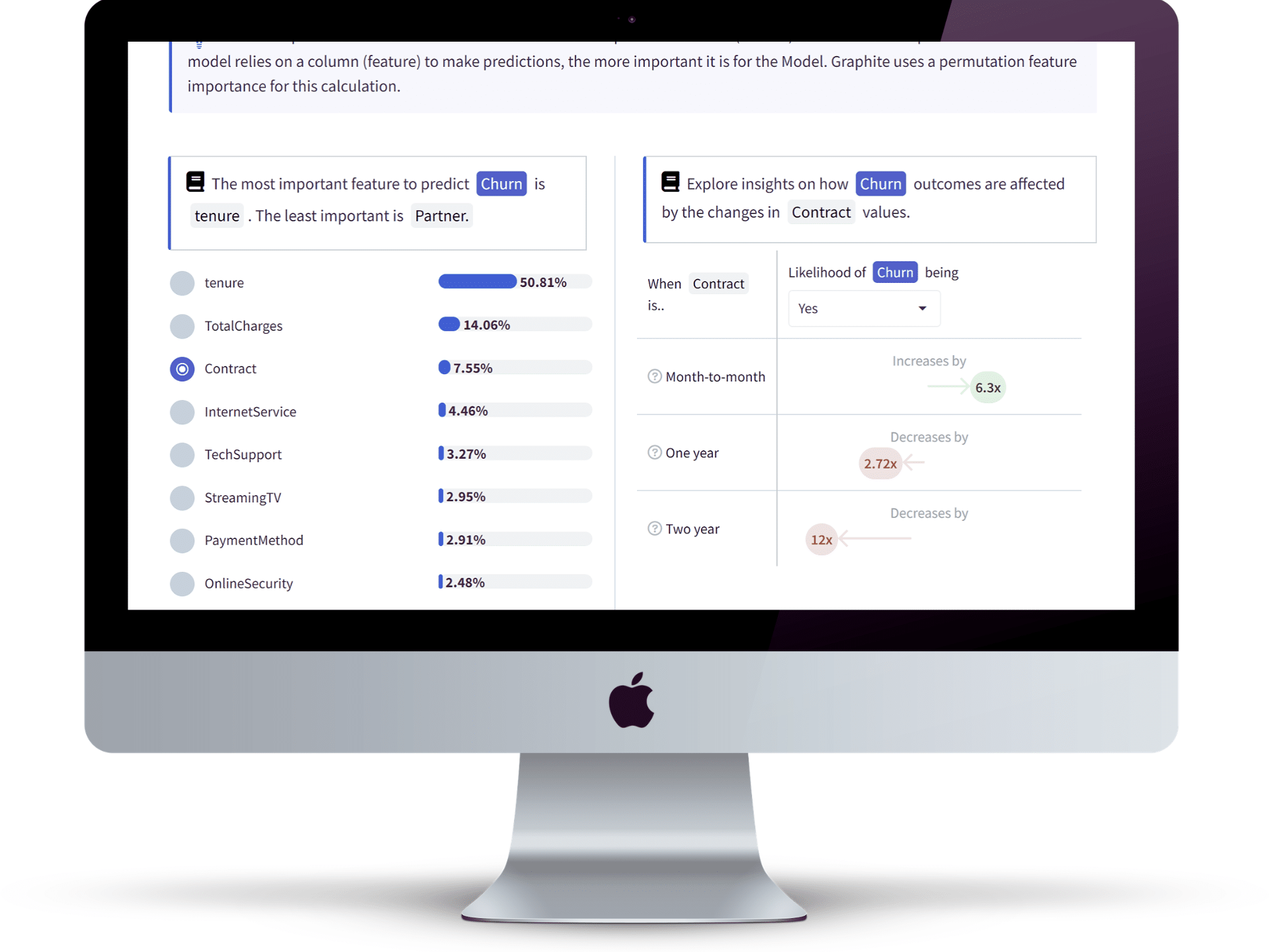

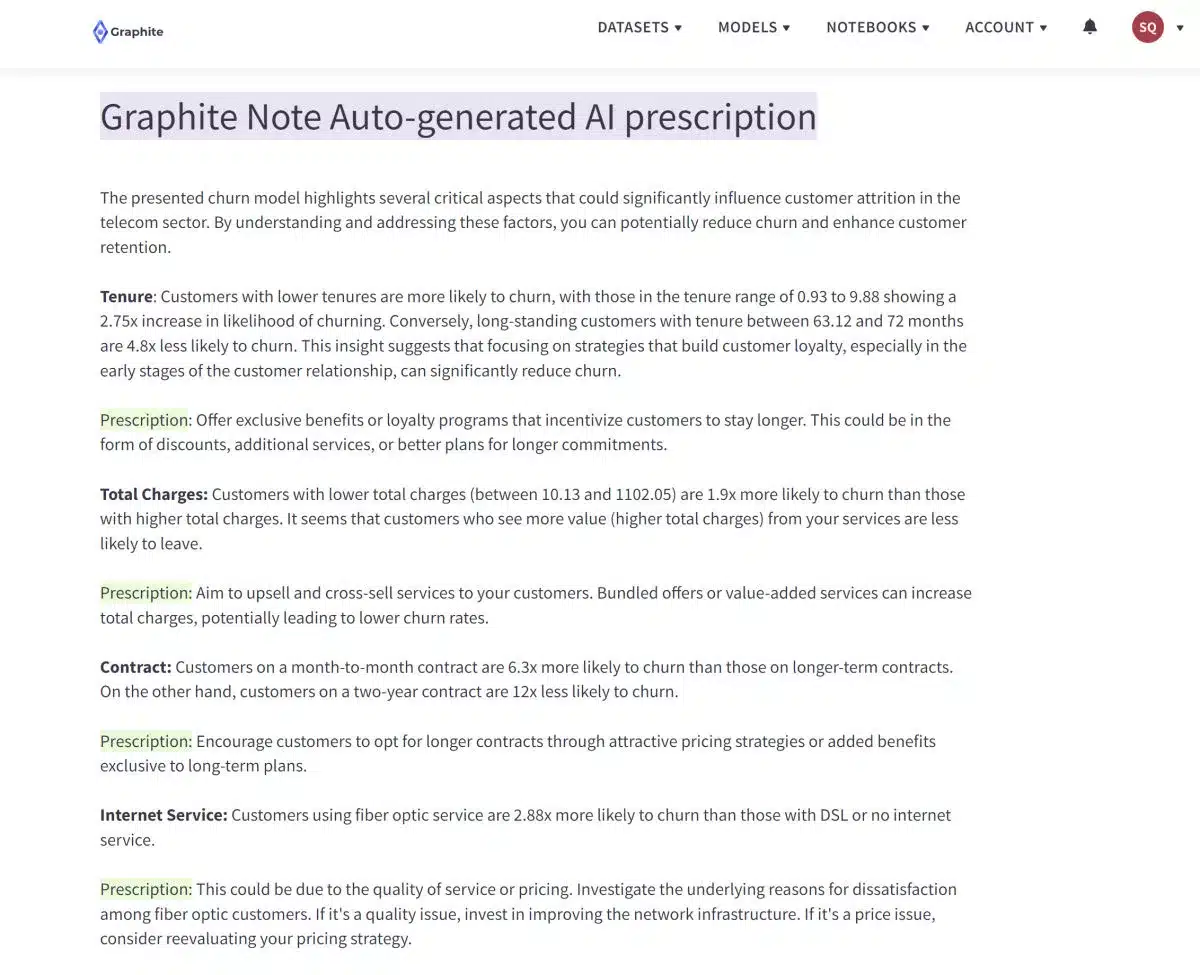

Graphite Note is a BI tool that can help. Graphite Note is a no-code predictive analytics platform that empowers businesses to easily build and deploy churn prediction models without the need for coding expertise. With its intuitive interface and built-in machine learning algorithms, Graphite Note simplifies churn prediction.

For example, by using BI tools, you can analyze customer behavior and identify specific actions or events that are correlated with churn. This could include factors like a decrease in engagement, a sudden drop in usage, or a change in purchasing patterns. By understanding these patterns, your business can take proactive measures to prevent churn, such as targeted marketing campaigns, personalized offers, or improved customer support.

BI tools also enable your business to visualize data in a way that is easy to understand and interpret. Through interactive dashboards and visualizations, you can gain a comprehensive view of your customer base and identify key insights. This visual representation of data empowers you to quickly identify trends, outliers, and potential areas of improvement.

Graphite Note offers a wide range of visualization options, including charts, graphs, and heatmaps. These visualizations can help you identify patterns and correlations that may not be immediately apparent in raw data. Presenting data in a visual format, you can easily communicate insights to your stakeholders and make data-driven decisions.

BI tools also help you to monitor and track the effectiveness of your churn prevention strategies. Setting up key performance indicators (KPIs) and tracking metrics, you can measure the success of their retention efforts and make adjustments as needed.

For instance, you can track metrics such as customer churn rate, customer lifetime value, and customer satisfaction scores. As you monitor these metrics over time, you can identify trends and patterns that may indicate the need for adjustments to your customer retention strategies. This iterative approach empowers you and your team to continuously improve your churn prediction and prevention efforts.

Building Effective Churn Prediction Models for Business Success

Churn prediction models help you identify customers who are likely to churn, enabling you to take proactive measures to retain those customers. Building an effective churn prediction model is not a simple task. It requires attention to several key elements that can make or break the success of the model.

Elements of a Successful Churn Prediction Model

1. Identify relevant data sources: Gather data from various customer touch points. These can include customer interactions, purchase history, and support interactions.

2. Ensure data accuracy and quality: Invest in data cleansing processes and validate your data to ensure the reliability of your results.

3, Select appropriate features and variables: Consider your customer demographics, purchase history, and support interactions. Analyze the variables to uncover patterns indicating churn likelihood.

4. Develop the initial churn prediction model: Use selected features to create your predictive model and apply the appropriate machine learning algorithms.

5. Validate and fine-tune your predictive model: Regularly test your model’s accuracy, and adjust your parameters as needed to improve performance.

6. Monitor and update the model continuously: You need to adapt to evolving customer behaviors and preferences, so you can make informed decisions based on up-to-date insights.

7. Implement proactive retention strategies: Identify your at-risk customers using the model and strategize your retention efforts to address specific customer needs.

8. Address customer concerns: Offer personalized solutions based on your model’s insights. This can help you cultivate long-term customer loyalty.

9. Measure and analyze results: Over time, track your improvement in customer retention, and monitor the effects on your customer satisfaction levels.

10. Refine and optimize your model: Use insights from your results to further improve the model. Remain committed to continuous improvement, as you continuously enhance prediction accuracy and effectiveness.

Conclusion

Understanding and managing customer churn is crucial for your business. Implementing effective customer retention strategies, leveraging technology for churn prediction, and focusing on customer satisfaction, your business can significantly reduce churn rates and build a loyal customer base. Proactively identifying at-risk customers and implementing targeted retention strategies allows companies to minimize churn and maximize customer lifetime value. Advanced Business Intelligence tools, such as Graphite Note’s no-code predictive analytics platform, play a key role in enhancing churn prediction and prevention efforts. Book your Graphite Note demo!