The Problem and the Challenge

Every executive has lived the promotion paradox. You launch a discount, your dashboards light up, and revenue looks higher. Celebration time.

But a few quarters later, finance walks in with a bitter pill: margin erosion, churn creep, and promo addiction among your most price-sensitive customers. The “win” looks a lot like a slow bleed.

Here’s the uncomfortable truth: promotions do not work uniformly. They don’t even work for most customers. A blanket discount across your base is as efficient as heating the street outside your headquarters: lots of energy, almost no useful return.

The real challenge is this:

- Which customers truly increase revenue when offered a promotion?

- Which ones pocket the discount without spending more?

- And which ones are actively damaged by it, training themselves to only buy on sale?

Until now, telcos have treated these questions as unknowable. With causal analysis, we can finally stop guessing.

The Dataset That Changed the Story

A sample of 250,000 subscriber transactions became the testing ground for this analysis.

- Target (outcome): Revenue per customer in euros

- Treatment: Whether a customer received a promotion (yes/no)

- Context we adjusted for: Region, customer type, tenure, plan tier, weekday

This is critical. Without adjusting for context, the results are noise. With adjustment, we can simulate the counterfactual: what would have happened if those exact customers hadn’t received the promotion.

What We Found

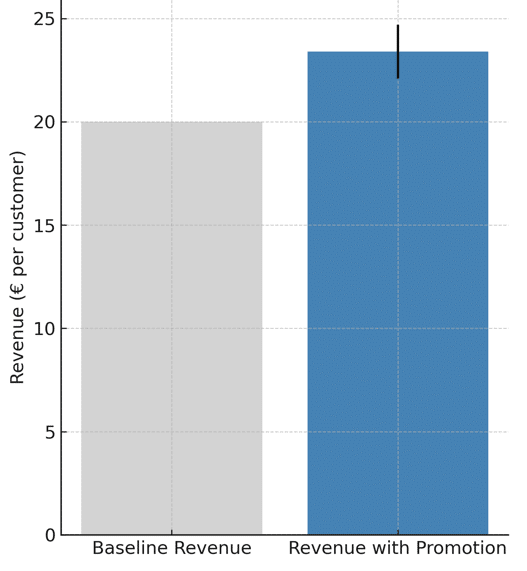

Promotions increased revenue by €3.40 per customer on average. But the distribution told the real story.

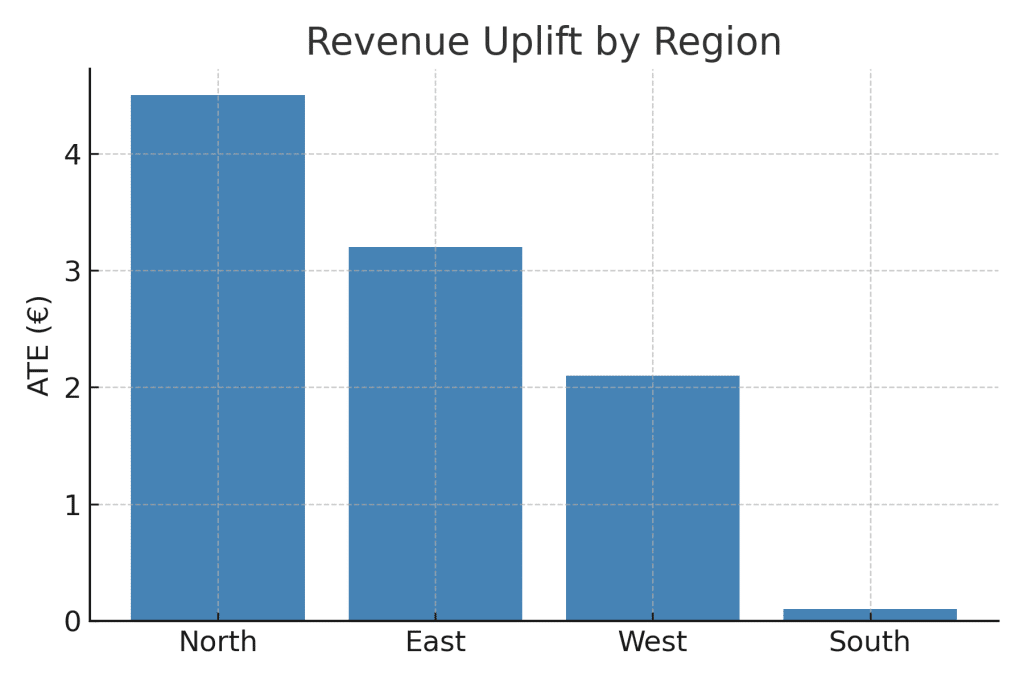

By Region

- North: +€4.50 uplift. Large, responsive base.

- East: +€3.20 uplift. Stable, scalable.

- West: +€2.10 uplift. Positive but modest.

- South: Flat at +€0.10. Almost no effect.

By Customer Type

- Postpaid: +€5.60 uplift. Deepens wallet share, worth targeting.

- Prepaid: +€0.90. Negligible. They churn fast, promotions don’t stick.

By Tenure

- 24 months: +€8.20 uplift. Loyal base, very responsive.

- 12–24 months: +€4.90 uplift. Strong engagement growth.

- <12 months: +€0.70 uplift. Early customers don’t move.

By Plan Tier

- Premium: +€9.40 uplift. The highest ROI segment.

- Standard: +€3.10 uplift. Broad base, still worthwhile.

- Basic: +€0.50 uplift. Flat, limited discretionary spend.

By Weekday

- Tue–Thu: +€5.10 uplift. Mid-week spike.

- Mon/Fri: +€2.90 uplift. Moderate.

- Sat–Sun: +€0.20 uplift. Customers distracted, no effect.

The Decision Intelligence Prescription

If this were a board presentation, the strategy slide would read:

- Target selectively. Focus on postpaid, Premium or Standard, tenure above 12 months, North and East regions.

- Time it right. Run campaigns midweek, not on weekends.

- Suppress waste. Skip prepaid, limit the South, and avoid Basic plan customers.

- Always pilot first. Validate in one region before scaling.

Why This Matters

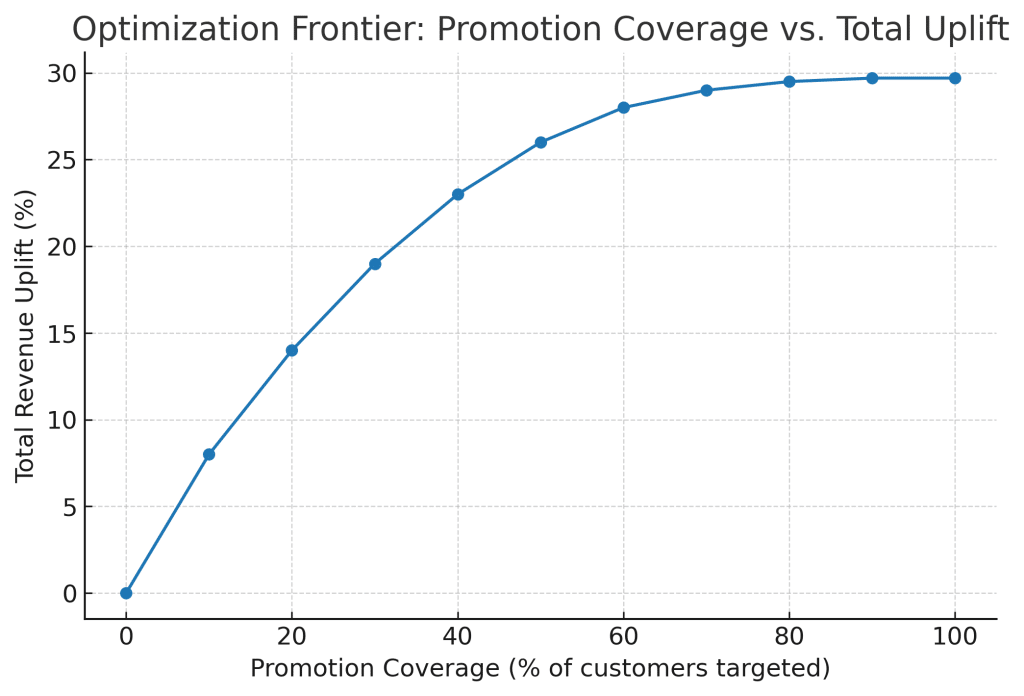

At scale — one million subscribers — this targeting strategy is worth six to eight million euros in incremental annual revenue. After promo costs, that nets roughly 4.5 million.

The old way — blanket promotions — would deliver less than half that at twice the cost.

The lesson: revenue uplift is real, but it lives in very specific segments. Everything else is noise.

Why You Can Trust This

Telco executives are right to be skeptical of models. But this isn’t hype or black-box AI.

- Outcome model fit (R² = 0.62) shows strong explanatory power

- Treatment predictability (AUC = 0.71) shows balance is acceptable

- Confidence intervals are tight, not guesswork

In plain English: the uplift we’re prescribing is statistically robust. It holds even when we adjust for context like region, tenure, and plan tier.

These recommendations aren’t suggestions. They are evidence-backed prescriptions.

The Contrarian View

This analysis flips telco convention. The default assumption has been: promotions grow revenue, more is better, everyone should get the offer.

The truth is sharper. Promotions are scalpels, not hammers. Used selectively, they cut churn risk and grow revenue. Used broadly, they bleed your margins dry.

Dataset Columns Used

For transparency, here’s what the dataset contained:

customer_id– anonymized subscriberregion– North, South, East, Westcustomer_type– Postpaid or Prepaidtenure_months– months activeplan_tier– Basic, Standard, Premiumweekday– day of activitypromotion_flag– whether customer received a promorevenue– euros per customer

This structure makes counterfactual analysis possible: we can see what would have happened without the promotion.

Conclusion

The lesson for telcos is as sharp as it is simple: stop running promotions like it’s 2005.

The question is no longer “Do promotions work?” The real question is “For whom, under what conditions, and at what cost?”

With Decision Intelligence, we can finally answer that. And the answer is clear: targeted promotions grow revenue, blanket ones don’t.

📅 Want to know how this looks on your own data? Book a demo with Graphite Note: https://graphite-note.com/book-demo/