Customer Lifetime Value Optimization Using Predictive Analytics

In the dynamic world of non-contractual businesses, understanding and optimizing Customer Lifetime Value (CLV) is crucial for sustained growth and success. CLV represents the total revenue a customer generates for your business throughout their entire relationship. Companies can allocate resources more effectively, tailor marketing strategies, and improve customer retention by focusing on this metric. Accurately assessing CLV can be challenging in industries such as retail, eCommerce, and digital agencies. However, predictive analytics offers a powerful solution to uncover hidden revenue opportunities and drive business performance.

- Customer Lifetime Value Optimization Using Predictive Analytics

- What is Customer Lifetime Value?

- Understanding Non-Contractual Customer Lifetime Value

- Definition and significance of non-contractual CLV

- Key challenges in assessing CLV for non-contractual businesses

- Role of predictive analytics in addressing these challenges

- Practical Applications of Predictive Analytics for CLV in Non-Contractual Businesses

- Future Number of Purchases Prediction

- Next Purchase Date Estimation

- Future Purchase Amount Forecasting

- Real-World Example: Benefits of CLV Prediction

- Conclusion

Predictive analytics uses data, statistical algorithms, and machine learning techniques to forecast future customer behavior. With the help of no-code predictive analytics SaaS tools, data analysts and BI teams can unlock valuable insights without needing extensive ML expertise.

In non-contractual businesses, where customer relationships are often more fluid, predicting future purchases, next purchase dates, and future purchase amounts is particularly valuable. By leveraging predictive analytics capabilities, businesses can anticipate customer behavior and implement targeted marketing strategies that effectively engage and retain customers.

In summary, customer lifetime value is essential for non-contractual businesses looking to optimize their marketing and sales efforts. Predictive analytics can help companies assess CLV and uncover new revenue opportunities. By harnessing the power of data, businesses can create tailored strategies that drive customer retention, increase CLV, and ultimately fuel growth.

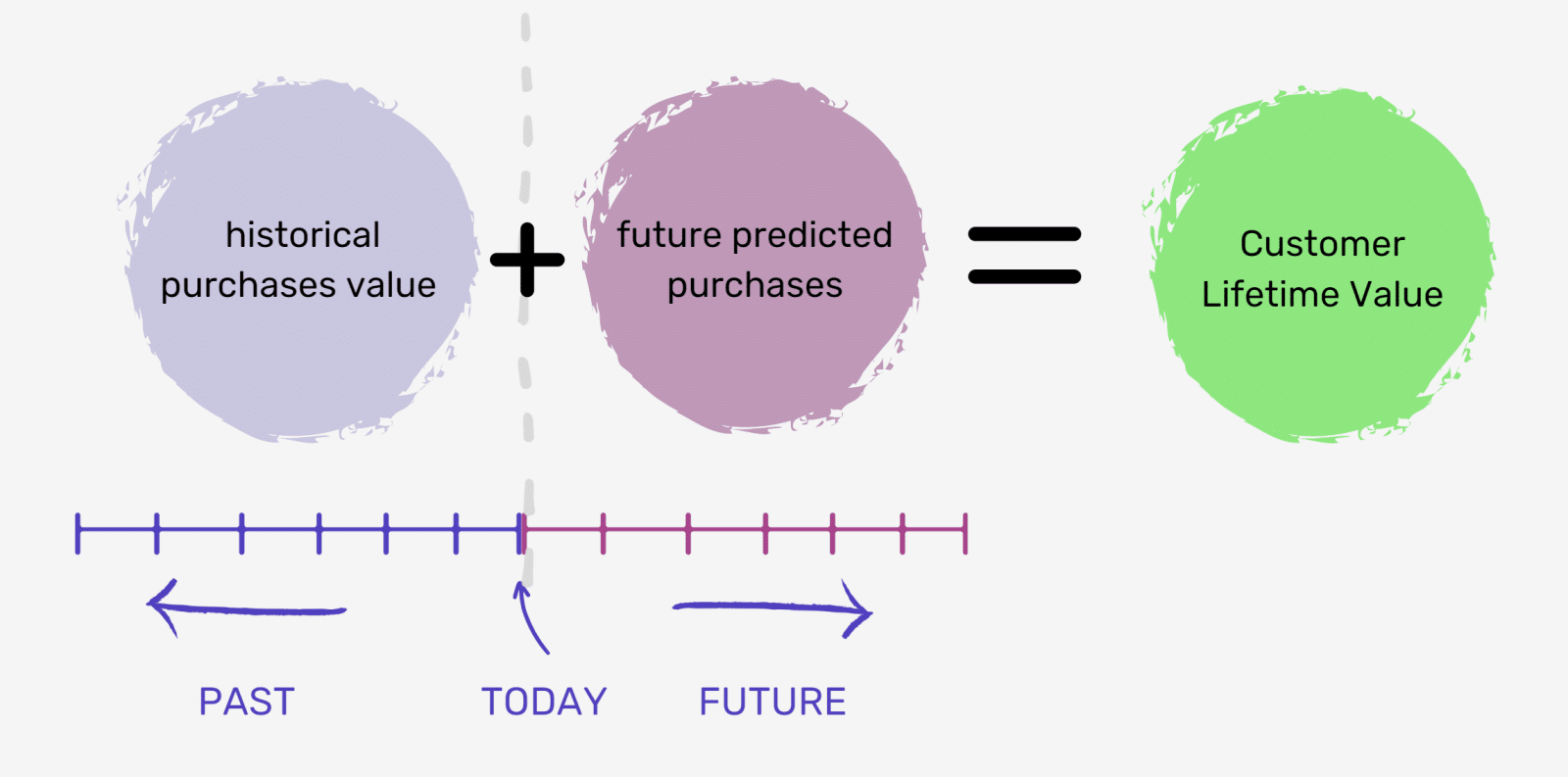

What is Customer Lifetime Value?

Customer Lifetime Value (CLV) is a critical metric that helps businesses gauge the long-term worth of each customer. It represents the total revenue a customer is anticipated to bring to your business throughout their entire relationship. Calculating CLV involves adding historical purchases to future predicted purchases, providing a comprehensive view of the customer’s value.

By understanding CLV, businesses can make well-informed decisions and develop strategies that boost their bottom line.

Understanding Non-Contractual Customer Lifetime Value

Definition and significance of non-contractual CLV

Customer Lifetime Value (CLV) is a metric that quantifies the total revenue a customer is expected to generate for a business throughout their relationship. In non-contractual businesses, such as retail, eCommerce, and digital agencies, customers are not bound by long-term contracts or subscription agreements. As a result, CLV assessment becomes a critical element for these businesses to understand customer behavior, optimize marketing efforts, and enhance customer retention.

In non-contractual settings, customers can switch between providers, making their purchasing patterns less predictable. Consequently, accurately estimating CLV becomes even more critical as it helps businesses allocate resources more effectively and identify high-value customers. By focusing on CLV, non-contractual businesses can target their marketing campaigns, design personalized offers, and drive customer loyalty.

Key challenges in assessing CLV for non-contractual businesses

Evaluating CLV in non-contractual businesses poses several challenges, including:

- Irregular purchase patterns: Unlike contractual businesses, where customers make recurring payments, non-contractual customers often exhibit sporadic and inconsistent purchasing behavior. This inconsistency makes it difficult to predict future revenue and estimate CLV accurately.

- Limited data: Non-contractual businesses often have fewer customer data to work with compared to their contractual counterparts. This lack of data hampers the ability to make informed decisions and effectively target high-value customers.

- Higher customer acquisition costs: Due to the absence of long-term contracts, non-contractual businesses usually face higher customer acquisition costs. As a result, accurately assessing CLV becomes vital to ensure that marketing efforts generate a positive return on investment (ROI).

- Varying customer behavior: In non-contractual industries, customers may have diverse preferences, behaviors, and expectations. This variation makes it challenging to develop a one-size-fits-all approach to estimate CLV and design targeted marketing campaigns.

Role of predictive analytics in addressing these challenges

Predictive analytics plays a pivotal role in overcoming the challenges associated with assessing CLV in non-contractual businesses. Predictive analytics can help businesses forecast future customer behavior, estimate revenue potential, and enhance marketing efforts by harnessing the power of data, machine learning, and statistical algorithms. Here’s how predictive analytics addresses the challenges of CLV assessment in non-contractual businesses:

- Predicting purchase patterns: With predictive analytics, businesses can analyze historical customer data to identify patterns and trends in purchasing behavior. This insight enables them to predict future purchases, estimate the next purchase dates, and forecast future purchase amounts more accurately.

- Utilizing available data: Predictive analytics can help non-contractual businesses maximize the limited data available. By leveraging advanced algorithms and machine learning models, companies can extract valuable insights from existing customer data and make informed decisions.

- Optimizing marketing ROI: Predictive analytics allows businesses to identify high-value customers and allocate marketing resources effectively. Businesses can optimize marketing ROI and reduce customer acquisition costs by targeting customers with a higher propensity to buy or those who are likely to churn.

- Personalizing marketing efforts: Predictive analytics helps businesses segment their customers based on behavior, preferences, and demographics. This segmentation allows them to design personalized marketing campaigns that resonate with individual customers, ultimately driving customer loyalty and increasing CLV.

Understanding and assessing Customer Lifetime Value is vital for non-contractual businesses looking to optimize their marketing strategies and enhance customer retention. Despite the unique challenges these businesses face, predictive analytics offers a powerful solution that enables them to predict customer behavior, allocate resources efficiently, and maximize revenue. By leveraging tools no-code predictive analytics, data analysts and BI teams can uncover valuable insights and make data-driven decisions that improve CLV and fuel business growth.

Non-contractual businesses face unique challenges when it comes to assessing Customer Lifetime Value. However, predictive analytics offers a powerful solution that enables these businesses to predict future customer behavior, allocate resources effectively, and maximize revenue.

Practical Applications of Predictive Analytics for CLV in Non-Contractual Businesses

In non-contractual businesses, customer behavior can be more challenging to predict than in contractual ones. Yet, understanding and anticipating customer actions are vital for driving customer retention and optimizing customer lifetime value (CLV). Predictive analytics offers powerful solutions to assess future customer behavior and helps businesses make informed decisions.

In this section, we’ll delve into three practical applications of predictive analytics for CLV in non-contractual businesses: the future number of purchases prediction, next purchase date estimation, and future purchase amount forecasting.

Future Number of Purchases Prediction

One of the most valuable insights predictive analytics can provide is an estimate of the number of future purchases a customer is likely to make. By analyzing historical data and customer behavior patterns, businesses can predict which customers are more likely to make repeat purchases and those at risk of churning. No-code predictive analytics platform simplifies this process by offering pre-built models that help data analysts and BI teams without ML expertise make accurate predictions.

With a future number of purchases prediction, businesses can:

- Identify high-value customers and develop personalized marketing campaigns to retain and upsell them.

- Optimize resource allocation by focusing on customers with the highest potential CLV.

- Detect early signs of customer churn and take proactive measures to re-engage them.

Next Purchase Date Estimation

Another practical application of predictive analytics in non-contractual businesses is estimating when a customer is likely to make their next purchase. By leveraging data on previous transactions and customer interactions, predictive analytics models can help companies to anticipate the optimal time to engage customers with targeted marketing campaigns.

Accurately estimating the next purchase date can have several benefits for businesses:

- Improve marketing campaign effectiveness by timing promotions, discounts, and special offers to coincide with a customer’s expected next purchase.

- Enhance inventory management by anticipating product demand and adjusting stock levels accordingly.

- Strengthen customer relationships by offering personalized and timely communication, increasing the likelihood of repeat purchases.

Future Purchase Amount Forecasting

Predictive analytics can also help businesses forecast the amount customers will likely spend in future transactions. Predictive models enable businesses to estimate the value of future purchases by analyzing customer spending habits and preferences, further refining CLV assessments.

Understanding the future purchase amount can help businesses:

- Tailor product recommendations and upsell opportunities based on a customer’s predicted spending.

- Develop tiered loyalty programs and incentives that encourage increased spending from customers.

- Allocate marketing resources more effectively by focusing on customers with higher predicted spending potential.

Real-World Example: Benefits of CLV Prediction

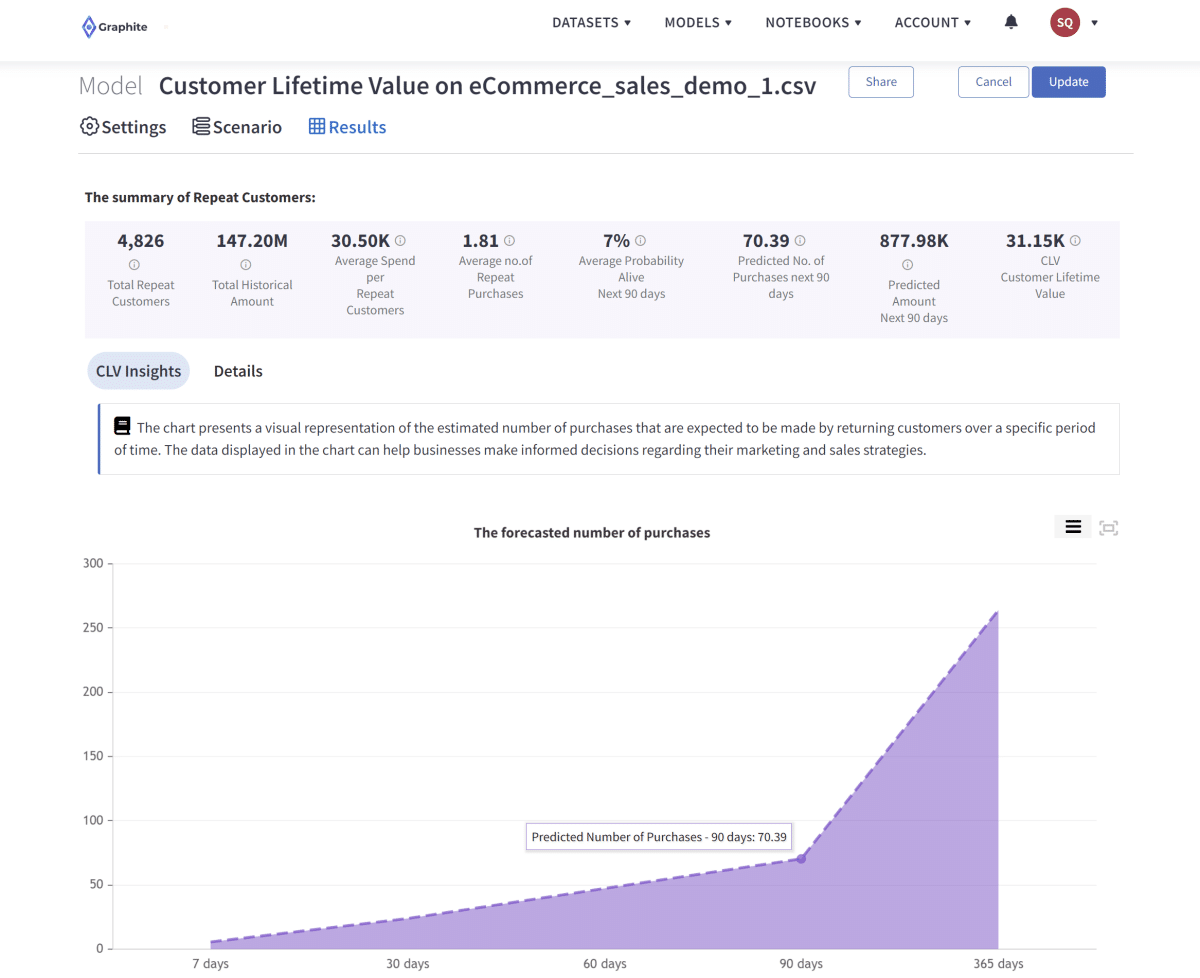

Imagine a growing eCommerce company that specializes in selling high-quality, eco-friendly products. The company has built a loyal customer base, but they want to expand its reach and improve its marketing efforts. To achieve this, the company decides to focus on understanding and optimizing their customer lifetime value (CLV) and implement predictive analytics using Graphite Note.

After analyzing its historical data, the eCommerce company identifies two main customer segments:

- Eco-conscious families and

- Environmentally-aware young adults.

The data reveals that eco-conscious families have a higher average CLV as they make larger and more frequent purchases. On the other hand, while enthusiastic about the brand, environmentally aware young adults have a lower CLV due to their limited purchasing power.

By leveraging Graphite Note’s predictive analytics capabilities, the company discovers that eco-conscious families are likely to spend more on baby and children’s products in the future. In contrast, environmentally-aware young adults are expected to spend more on personal care and home items. Additionally, Graphite Note helps the company estimate the next purchase date for each customer segment, allowing them to time their marketing campaigns effectively.

Armed with this information, the eCommerce company optimizes its marketing spend by allocating more resources to target eco-conscious families, as they have a higher CLV and potential future spending. They develop personalized marketing campaigns featuring baby and children’s products for this segment and offer loyalty program incentives to encourage repeat purchases.

For environmentally-aware young adults, the company focuses on building brand loyalty and nurturing long-term relationships. They create engaging content and promotions centered around personal care and home items, aiming to increase the CLV of this segment over time gradually.

As a result of implementing predictive analytics and understanding the CLV of their customer segments, the eCommerce company can make data-driven decisions that lead to improved marketing effectiveness and increased revenue. By anticipating future spending patterns and purchase behavior, the company can tailor their marketing strategies to resonate with its target audience, ultimately reducing customer acquisition costs and ensuring a higher return on investment.

This example illustrates the real benefits of knowing CLV and the expected amount each customer will spend in the future. By leveraging predictive analytics, businesses can optimize their marketing spend, allocate resources better, and make informed decisions that drive growth and success.

Conclusion

In today’s fast-paced and competitive business landscape, non-contractual companies must continuously innovate and adapt to stay ahead of the curve. By focusing on understanding and optimizing customer lifetime value (CLV), businesses can unlock new revenue opportunities and drive sustainable growth. Predictive analytics, particularly user-friendly no-code solutions like Graphite Note, offers invaluable insights that can transform the way businesses approach marketing and customer retention.

The power of predictive analytics lies in its ability to anticipate customer behavior and preferences. By leveraging data-driven insights, businesses can develop personalized marketing campaigns that resonate with their target audience, ensuring higher engagement and loyalty. Companies can also optimize their marketing spend by allocating resources to customers with the highest potential CLV, ultimately reducing customer acquisition costs and boosting return on investment.

Furthermore, predictive analytics empowers businesses to identify potential churn risks, allowing them to take proactive measures to re-engage and retain at-risk customers. By focusing on customer retention and maximizing CLV, non-contractual businesses can achieve long-term success and profitability.

The practical applications of predictive analytics in non-contractual businesses, such as the future number of purchases prediction, next purchase date estimation, and future purchase amount forecasting, demonstrate the immense potential of this technology. By embracing a no-code predictive analytics platform, businesses can harness the power of data and transform their approach to marketing and customer relationship management.

In conclusion, understanding and optimizing CLV is essential for non-contractual businesses looking to thrive in today’s competitive marketplace. By leveraging the power of predictive analytics, companies can make informed, data-driven decisions that lead to increased customer loyalty, optimized marketing strategies, and sustainable revenue growth. It’s time for businesses to embrace the future and unlock the full potential of predictive analytics in maximizing customer lifetime value. So, take the first step today and explore how Graphite Note can revolutionize your business strategy and propel you toward long-lasting success.