For more than a few decades, Microsoft Dynamics partners have built their businesses on implementations, integrations, and reporting. The formula has been durable. Deploy the system. Shape the data. Produce BI dashboards. Train users. Move to the next engagement.

But if you step back and look at how customer expectations have shifted over the past 24 months, it becomes clear that this formula is running out of runway.

Leaders in manufacturing, consumer goods, retail, and distribution are no longer satisfied with dashboards that explain yesterday. They want clarity about tomorrow. They want confidence about decisions. And they want answers their ERP or BI layer cannot give them today.

Across dozens of conversations with Dynamics partners globally, the same pattern repeats. Clients are asking questions like:

- What’s likely to happen next month or next quarter?

- Why did a specific metric suddenly shift?

- Which actions will actually improve performance?

These are predictive and prescriptive questions.

Dashboards weren’t designed for them.

Traditional BI can’t answer them.

And most Dynamics partners quietly admit they don’t have the internal data-science capability to solve them.

This is the gap the industry isn’t talking about enough, and the one that creates the largest opportunity in years for ERP partners who move early.

Why the Old Services Model Is Breaking Down

The typical ERP partner value chain remains rooted in historical insight. By design, ERP systems capture transactions.

Dashboards visualise those transactions.

Analysts interpret the patterns.

But in 2024 and 2025, business users have moved beyond interpretation and into expectation. They want to know:

- What will happen if we change a price?

- Where will inventory bottlenecks appear?

- Which customers are at risk of churning?

These aren’t reporting problems.

They are decision problems.

And because partners aren’t equipped with data-science teams, two things happen:

- Clients look elsewhere for “AI help.”

Usually to boutique analytics firms or newly rebranded “AI consultancies.” - Partners get pushed down the value chain.

They become implementation vendors instead of strategic advisors.

Your offer material captures this challenge accurately: Dynamics partners rarely have the internal data-science resources to deliver predictive or causal insights, and custom ML projects are expensive, inconsistent, and difficult to maintain.

The industry has hit a capability ceiling.

But capability ceilings don’t eliminate demand. They just displace it.

This gap exists across nearly every Dynamics practice.

The opportunity is filling it.

The Idea That Changes Everything: Co-Building AI Packs

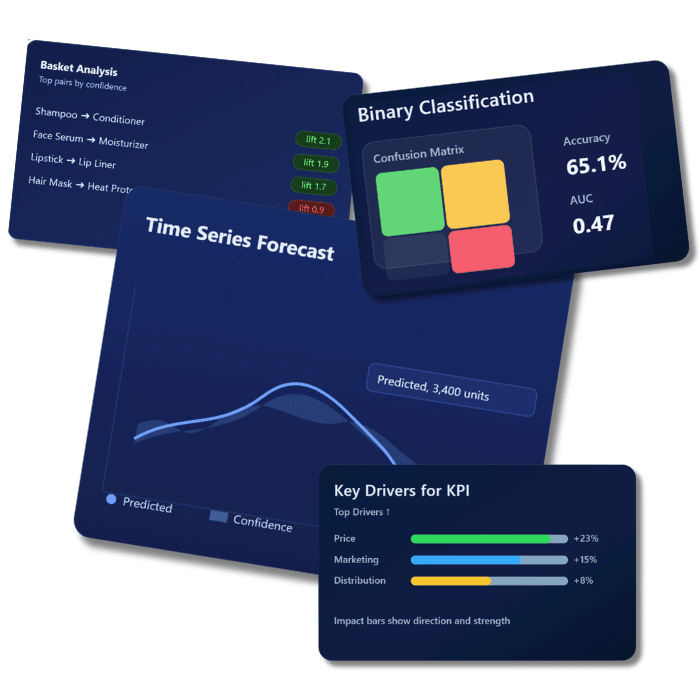

The most interesting shift happening now is a new model emerging for partners: co-building AI Packs with a no-code Decision Intelligence platform.

Our offer explains it clearly: Instead of building custom ML from scratch, partners collaborate on industry-ready model sets; typically three to five ML models tailored to the client’s vertical.

Examples from your Dynamics ERP partner material include:

Consumer Goods

- Demand forecasting by SKU/store/week

- Customer churn scoring

- Basket affinity analysis

Manufacturing

- Scrap percentage causal model (Decision Impact model)

- Margin driver insights

- Inventory optimisation forecasting

These aren’t theoretical use cases. They’re grounded in the real questions clients already ask. And they are repeatable.

That’s the breakthrough.

Partners bring the business context, SQL queries for modeling.

Graphite Note brings the ML engine, templates, and infrastructure.

Together, we create something scalable that can be deployed across dozens of similar clients.

This solves three problems at once:

- The skills gap (no data scientists needed).

- The scalability gap (no rebuilding from zero each time).

- The commercial gap (predictive services become recurring revenue instead of one-off reports).

This is the moment predictive analytics becomes accessible to the services layer of the Dynamics ecosystem instead of just the data-science elite.

How an AI Pack Works

- Partner provides domain knowledge + ERP data

- Graphite Note provides the no-code ML engine

- Together we configure forecasting, churn, margin driver models

- Pack becomes reusable across client base

- Partner delivers predictive services without ML overheadThis model changes partner economics far more than most realise.

What Happens When Partners Start Delivering Predictive Answers

Partners who adopt predictive and causal analytics don’t just produce better insights—they transform their position with the client.

Example outcomes listed in the material include:

- A +18 percent improvement in forecast accuracy across SKUs, enabling companies to reduce excess inventory and avoid stockouts.

- A 27 percent reduction in churn in 90 days by targeting retention actions toward the right customers.

- More than 120 hours saved per month through automated margin driver analysis and prescriptive next steps.

These results are not traditional “nice to have” reporting outcomes.

They sit at the level of operations, finance, and customer strategy.

They drive real business change.

And that is exactly where ERP partners want to be positioned.

Predictive services elevate the partner relationship from technical implementer to strategic advisor.

Why This Moment Matters for Dynamics Practices

Over the next 12 to 36 months, every ERP partner will watch their clients increase AI spending. But the distribution of that spending is not equal.

The organisations that win the AI budget are those who:

- Understand the client’s business deeply

- Have existing trust and relationships

- Can deliver results without requiring massive technical lift

ERP partners hold all three advantages.

The only barrier has been capability.

And that barrier is finally disappearing.

No-code Decision Intelligence platforms make forecasting, uplift modelling, attribution, basket analysis, and causal inference available without Python, without ML engineers, and without long-term development cycles.

What used to require a team of specialists can now be co-built, deployed, and repeated across the partner’s customer base.

This is the most important turning point for Dynamics services since the rise of managed cloud.

Partners who adopt predictive services will create:

- New monthly recurring revenue streams

- Differentiated offerings in crowded markets

- Higher margin service packages

- Stronger customer retention

- More strategic conversations at the executive table

Partners who don’t will continue delivering descriptive dashboards while competitors deliver prescriptive guidance.

The market has already shifted. The question is whether partners will shift with it.

What This Means If You’re a Dynamics Partner Today

Look at your existing clients.

Look at their datasets.

Look at their questions.

Almost every Dynamics customer is sitting on years of transactional history that could produce valuable forecasts, probability scores, and “what-if” simulations. And almost none of them have the internal capability to do it alone.

Partners already own:

- The relationship

- The domain understanding

- The access to data

- The trust

The missing piece has been the machinery to turn that data into forward-looking recommendations.

That piece is available now.

And this explains the most eye-opening insight from the new Dynamics offer:

Partners don’t need to become AI experts to deliver AI outcomes.

They just need the right Decision Intelligence engine to scale them.

The early adopters in the Dynamics ecosystem will define the next generation of services—ones centered on answers rather than reports.

Because in the end, success isn’t about delivering more dashboards.

It’s about changing the decisions that shape the business.