RFM analysis and customer segmentation

RFM analysis helps you understand your customers. RFM metrics help you enhance your customer segmentation. Customer segmentation groups your customers based on their behaviors, preferences, and backgrounds. Effective customer segmentation strategies help you create personalized experiences. These keep your customers returning to your business.

You can combine RFM (Recency, Frequency, Monetary) analysis with effective customer segmentation strategies. No-code predictive analytics tools help you do this. Knowing your customers and catering to their needs is crucial. By using RFM analysis, you can get a closer look at the customer segments you’re dealing with. This insight helps you create effective marketing campaigns tailored to your customer segments. These make your marketing efforts more effective and improve customer retention.

What is RFM analysis?

RFM analysis enables you to focus on customer retention rather than only customer acquisition. You can prioritize and target your marketing campaigns more effectively using RFM metrics. RFM analysis helps you understand customer interactions’ Recency, Frequency, and Monetary value. RFM analysis helps you to adapt your marketing tactics as customer preferences and behaviors change. RFM customer value optimization software helps you stay prepared for market changes. RFM analysis helps you respond proactively to shifts in customer behavior. Knowing your customer RFM values helps you optimize your business operations.

What is Recency?

Recency refers to the time elapsed since a customer’s last interaction with your business. This could be the most recent time they’ve bought from you. Customers who have recently interacted with your business are more likely to be engaged. Recent customers are generally ready to make future purchases.

What is Frequency?

Frequency measures the number of interactions or purchases a customer has made within a specific time frame. Frequent customers have a stronger bond with your brand and are likelier to return for more.

What is Monetary?

Monetary is the monetary value of the total revenue generated by a customer. High monetary value customers contribute significantly to your bottom line. High monetary value customersare often the most profitable.

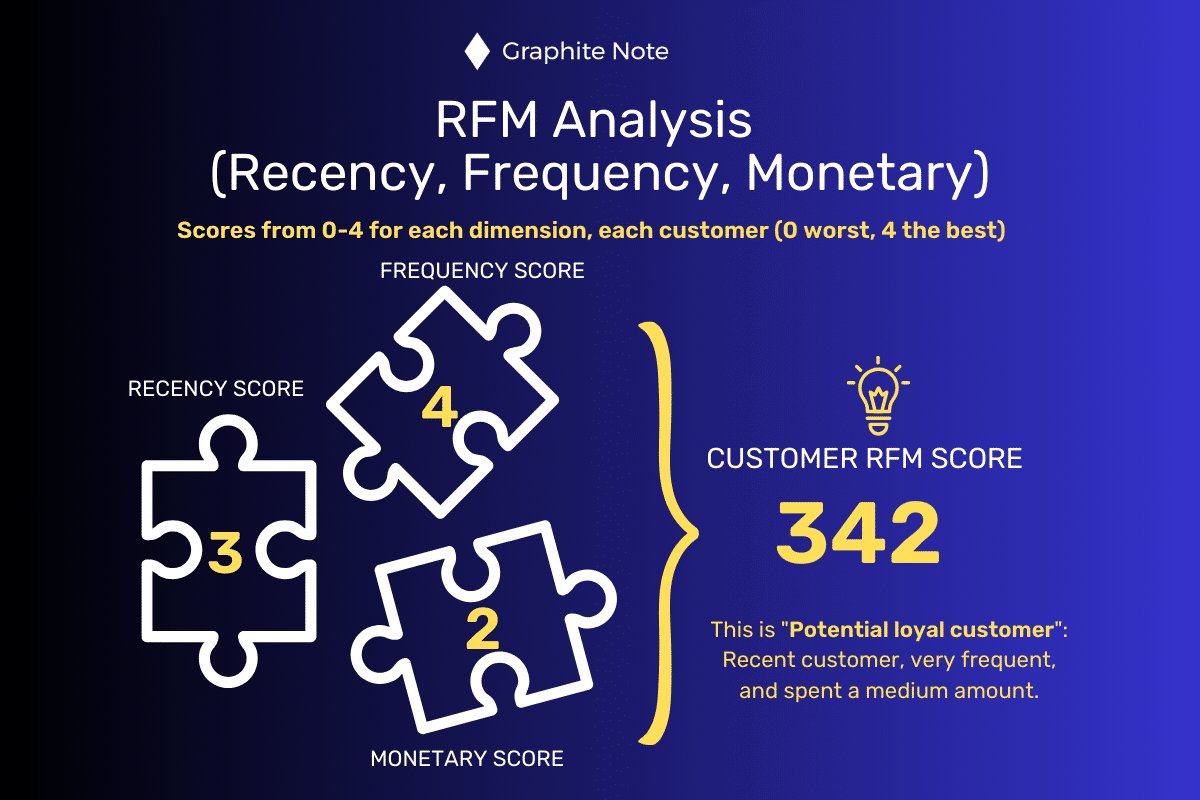

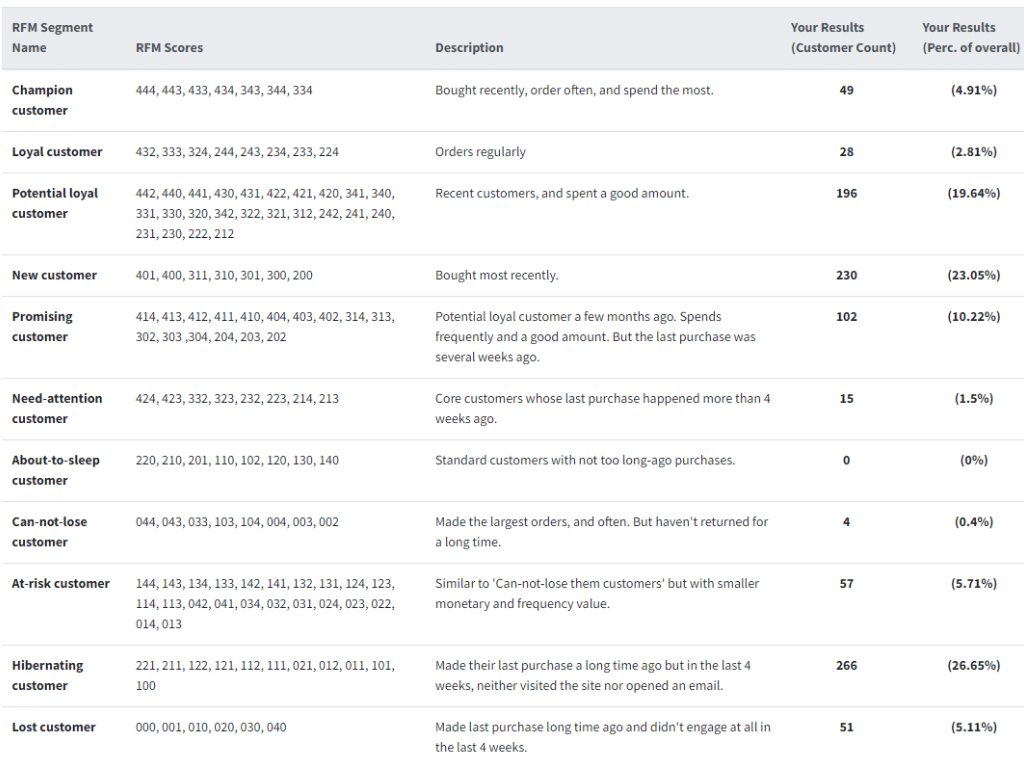

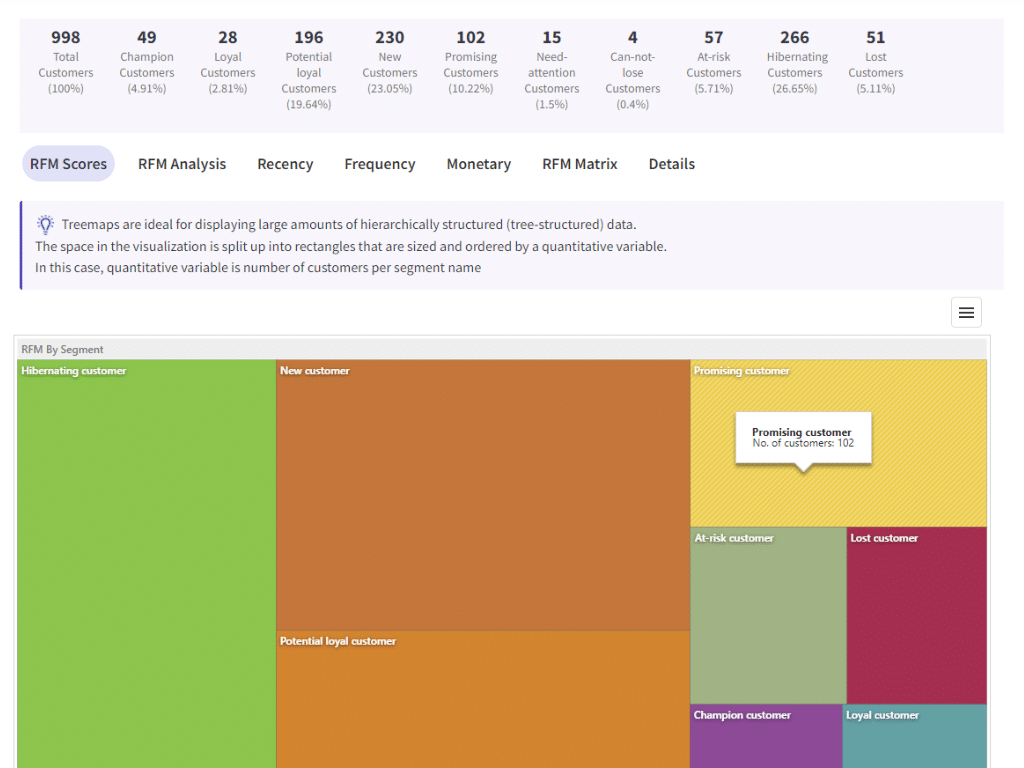

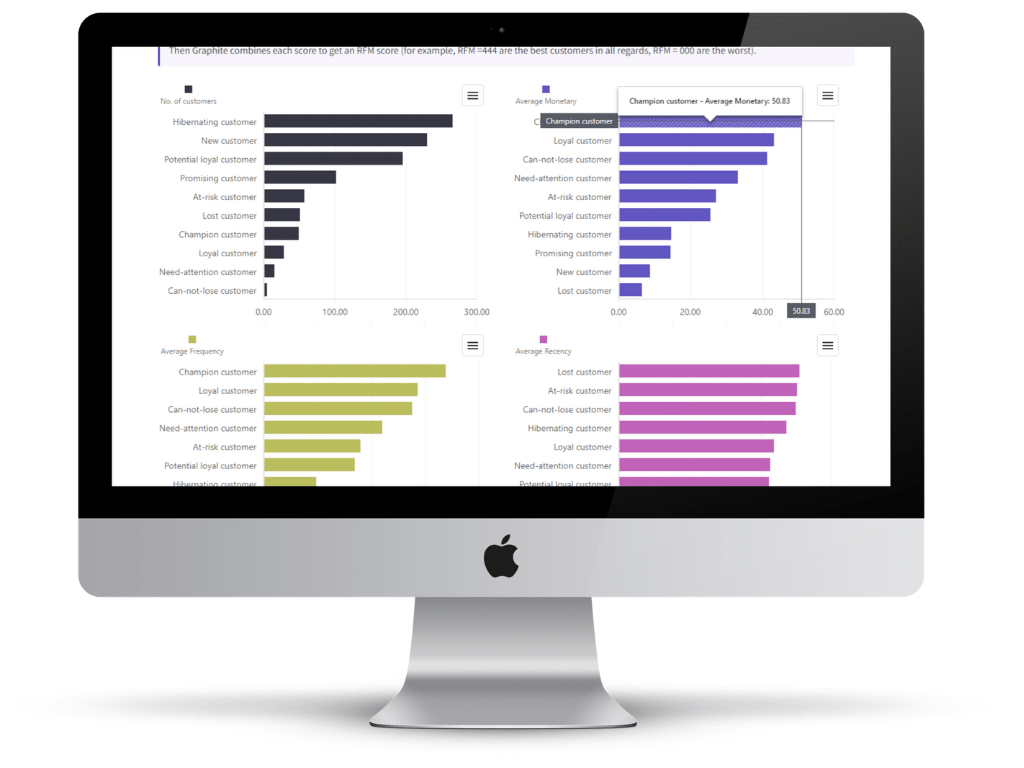

RFM Scoring Explained

You assign each RFM metric (Recency, Frequency, and Monetary) a RFM score from 0 to 4.

For RFM values, a score of 0 indicates the lowest value. A score of 4 represents the highest value. RFM scores help you:

- Enhance your targeted marketing campaigns: Your RFM metrics help you prioritize your customer segments.

- Optimize your customer relationships: RFM metrics enable you to better understand your customers’ preferences and behaviors.

Allocate your resources: Your RFM analysis helps you allocate marketing resources in the most effective way. You can create targeted campaigns that focus on your customers that are most likely to convert. You can create targeted customer segments and optimize your marketing efforts.

What are the benefits of RFM analysis?

RFM analysis offers numerous benefits. By focusing on the most valuable aspects of customer interactions – Recency score, Frequency score, and Monetary score, you can data-driven insights to drive meaningful improvements across various aspects of your business. Some of the most notable benefits of RFM analysis include the following

- Improved customer retention: By identifying high-value customers who may be at risk of disengaging, you can develop targeted strategies to re-engage them and foster long-term loyalty. Focusing on the right RFM segments helps you improve customer retention.

- Increased revenue: By focusing marketing efforts on high-value customer segments, you can maximize the return on investment from your marketing campaigns, leading to increased revenue and profitability. Increased conversion rates lead to higher revenues.

- More effective marketing strategies: RFM analysis enables you to create personalized customer experiences, making marketing campaigns more relevant and effective. This leads to higher customer satisfaction and loyalty.

3 Inspiring Stories of RFM Customer Segmentation

Ecommerce Business 1: A Fashion Retailer’s Journey to Customer Retention

Challenge: Escape the Vicious Cycle of Low Retention Rates

Despite a steady flow of new customers, the ecommerce business found customer retention difficult. This led to declining revenue and stagnating growth. The retailer knew that understanding and catering to the needs of existing customers was essential. RFM analysis enabled them to improve their customer retention.

RFM Analysis Implementation: Targeting High-Value Customers with Personalized Promotions

The retailer turned to RFM analysis, a powerful customer segmentation tool. They focused on the recency, frequency, and monetary value of customer purchases. They were able to pinpoint their most valuable customers who hadn’t made recent purchases. The retailer developed personalized promotions and incentives. The retailer tailored their marketing efforts to re-engage these high-value customers. They crafted relevant and enticing email campaigns. They offered exclusive discounts and early access to new product lines.

Results: A Remarkable Turnaround in Retention and Revenue

The impact of RFM analysis was astonishing. RFM analysis enabled a significant increase in customer retention. Once-lost customers returned to make new purchases. Revenue for the ecommerce store climbed. High-value customers were drawn in by the personalized approach. These high-value customers then chose to remain loyal to the brand. The retailer attributed their success to the targeted marketing campaigns. These were informed by effective RFM analysis.

Ecommerce Business 2: An Electronics Store’s Quest for Customer Lifetime Value

Challenge: Tackling High Customer Acquisition Costs and Low Customer Lifetime Value

An electronics store battled high customer acquisition costs and diminishing customer lifetime value. Despite attracting new customers, the store needed to enhance customer retention. The store also needed to grow their customer lifetime value.

RFM Segmentation: Prioritizing High-Value Segments and Personalized Recommendations

The store employed RFM analysis for RFM segmentation and identify high-value segments. They prioritized marketing efforts towards these segments. This ensured they invested resources where they would have the most significant impact.

The store leveraged RFM modeling to create personalized product recommendations. Using historical purchase data analysis, the began to offer relevant, appealing product suggestions. This encouraged repeat purchases.

Results: A Winning Strategy for Customer Satisfaction and Lifetime Value

The store’s decision to use an effective RFM model paid off. Their customer acquisition cost dropped. Their customer lifetime value increased. Their customers expressed higher levels of customer satisfaction and loyalty.

SaaS Business: A Software Company’s Battle Against Churn

Challenge: High Churn Rates Threaten Subscription-Based Business

A growing SaaS company found itself in a precarious position as it faced high churn rates. The business battled to identify which customers were most likely to cancel their subscriptions. This made it difficult to address their needs and maintain long-term relationships.

RFM Implementation: Proactive Communication and Tailored Solutions

To combat churn, the company turned to RFM analysis. They assessed their customers’ recency, frequency, and monetary scores. They were able to identify high-risk customers and act before it was too late. The company shifted its focus to proactive communication. The business contacted high-risk customers to understand their concerns and offer tailored solutions. They develop targeted resources to address the specific needs of these customers. The business aimed to offer value-added services to demonstrate a genuine interest in customer success.

Results: A Significant Reduction in Churn Rates and Improved Customer Loyalty

The SaaS company’s targeted efforts led to impressive results. Churn rates dropped, and customer loyalty improved. Clients felt valued and understood. RFM analysis had informed the personalized support and tailored solutions. The SaaS business retained more customers and cultivated stronger relationships. This contributed to the company’s long-term success.

Conclusion

RFM analysis is a key for unlocking customer value. RFM analysis helps you better understand and cater to your customers’ needs. By segmenting your customer base and prioritizing marketing efforts based on RFM scores, you can prioritize your attention on high-value customers. RFM analysis gives you with invaluable insights that will enable you to create targeted, personalized customer experiences. RFM analysis can lead to significant improvements in customer retention, revenue, and overall business performance.

Ready to Unlock the Power of RFM Analysis with Graphite Note?

Don’t let complex coding or formulas hold you back from discovering the benefits of RFM analysis and customer segmentation. With Graphite Note’s no-code predictive analytics, you can leverage the power of machine learning to uncover valuable insights about your customers with ease.

Say goodbye to the technical barriers that once stood between you and effective customer segmentation. With Graphite Note, you’ll gain access to a user-friendly platform that automates the RFM analysis process, allowing you to focus on creating targeted marketing strategies that drive results.

Don’t miss out on the opportunity to transform your business with data-driven insights. Try Graphite Note today and experience the difference that no-code predictive analytics can make in your RFM analysis and customer segmentation journey. Take the first step by signing up for a free trial and watch as your business reaches new heights of success.