RFM analysis has remained a marketer’s favorite in understanding customers. Every marketer knows the customer is king. New-age marketers know it is imperative to sift the best from the rest. Deviating attention from customers who matter or treating them the same as the others can endanger customer relationships. Building a loyal relationship with the best customers or converting prospects into repeat customers can be pivotal in turning any business around.But how can you evaluate customers based on the value they bring to the company? This is why your business needs RFM analysis, a popular and verified method of customer valuation.

What is RFM Analysis?

RFM analysis helps you understand your customers. RFM metrics can help you enhance your customer segmentation. Customer segmentation groups your customers based on their behaviors, preferences, and backgrounds. Effective customer RFM segmentation strategies help you create personalized experiences. These keep your customers returning to your business. You can combine RFM (Recency, Frequency, Monetary) analysis with effective customer RFM segmentation strategies.

Using an RFM model, you can get a closer look at each customer RFM segment your business deals with. Understanding each RFM segment helps you create effective marketing campaigns tailored to your customer segments. These make your marketing efforts more effective and improve customer retention. RFM segment analysis enables you to focus on customer retention rather than only customer acquisition. You can prioritize and target your marketing campaigns more effectively using RFM metrics.

RFM analysis helps you understand customer interactions’ Recency, Frequency, and Monetary value. RFM analysis helps you to adapt your marketing tactics as customer preferences and behaviors change. RFM modeling helps you stay prepared for market changes. RFM analysis helps you respond proactively to shifts in customer behavior. Knowing your customer RFM values helps you optimize your business operations and RFM marketing strategies.

RFM analysis is an acronym for Recency, Frequency, and Monetary Value. Knowing the ins and outs of your RFM segments enables you to segregate your customer base. RFM customer segmentation quantifies your customers based on three key factors, using a range of data points:

- Recency: Your customer’s recency score indicates how recently your customer has engaged with your business. A recency score refers to the time elapsed since a customer’s last interaction with your business. This could be the most recent time they’ve bought from you. Customers who have recently interacted with your business are more likely to be engaged. Recent customers are generally ready to make future purchases.

- Frequency: Your customer’s frequency score indicates how often a customer makes a purchase or visits your website to explore what’s on offer. Frequency measures the number of interactions or purchases a customer has made within a specific time frame. Frequent customers have a stronger bond with your brand and are likely to return for more.

- Monetary Value: The monetary score is a measure of the customer’s spending capacity. This includes the average spend of a customer per visit or the overall transaction value in a given period of time. The monetary score is the monetary value of the total revenue generated by a customer. High monetary value customers contribute significantly to your bottom line. High monetary value customers are often the most profitable.

RFM Scoring Explained

You assign each RFM metric (Recency, Frequency, and Monetary) a RFM score. RFM scores are ranked from 0 to 4.

For RFM values, a score of 0 indicates the lowest value. A score of 4 represents the highest value. RFM scores help you:

- Enhance your targeted marketing campaigns: Your RFM metrics help you prioritize your customer segments, so you can focus on high value purchasers and aim to increase your Average Order Value.

- Optimize your customer relationships: RFM metrics enable you to better understand your customers’ preferences and behaviors. Your RFM analysis can help you enhance conversion rates, improve your response rates, and optimize your marketing strategy.

- Allocate your resources: Your RFM analysis helps you allocate marketing resources and marketing budget in the most effective way. You can create targeted campaigns that focus on your customers that are most likely to convert. You can create marketing campaigns that focus on particular customer segments. These can focus on your high value customers, your most profitable customers, or customers who haven’t shopped with you in a long time. You can create targeted customer segments and optimize your RFM marketing efforts.

RFM analysis helps marketers analyze how to segment customers. You can group your customer base into different segments. These customer segments could be based on a range of factors, which could include:

- The monetary values of each purchase made from your business., per customer.

- Your consumer behavior analytics. Consumer behavior can range from time spent on your website, to any other data point that can support your marketing program objectives. Consumer behavior analysis gives you important indicators that support your RFM analysis.

- The monetary values of your customers’ spending habits.

- Your customers’ purchasing behavior.

- Your marketing spend. Your marketing spend per customer helps you understand how much you need to spend to enhance customer purchasing behavior.

- Customers who are loyal. Loyal customers usually interact with your business often and have a high number of customer transactions.

- Customers who are likely to make purchases in the near future. You can assess and devise a marketing program to attract your potential customers.

- Customers who generate the most revenue for the business, including old and new ones. This can help direct your marketing strategy and efforts.

- Customers who make periodic purchases but can be turned into loyal and repeat customers.

- One-time customers.

The RFM Score

Customers are scored individually on all three aspects. The total tally is an average of all three scores. The best customers score high in each of the three specified fields and have a high RFM score.

Usually, each of the three individual scores is given equal weighting when calculating the average. This can vary depending upon the types of business you’re engaged in. It all depends on how you view each RFM metric in terms of importance, and how it will direct your marketing strategy.

Why is RFM Analysis Important?

RFM analysis helps businesses understand their customers better and engage with them in a bespoke manner. It can help you to:

- Figure out and utilize targeted communication (content + channel) for your customers.

- Develop, sustain, and improve customer relationships.

- Trial your product pricing.

- Upsell and cross-sell across various customer categories.

Effective RFM analysis could make a tangible difference to your business in terms of profitability and customer retention.

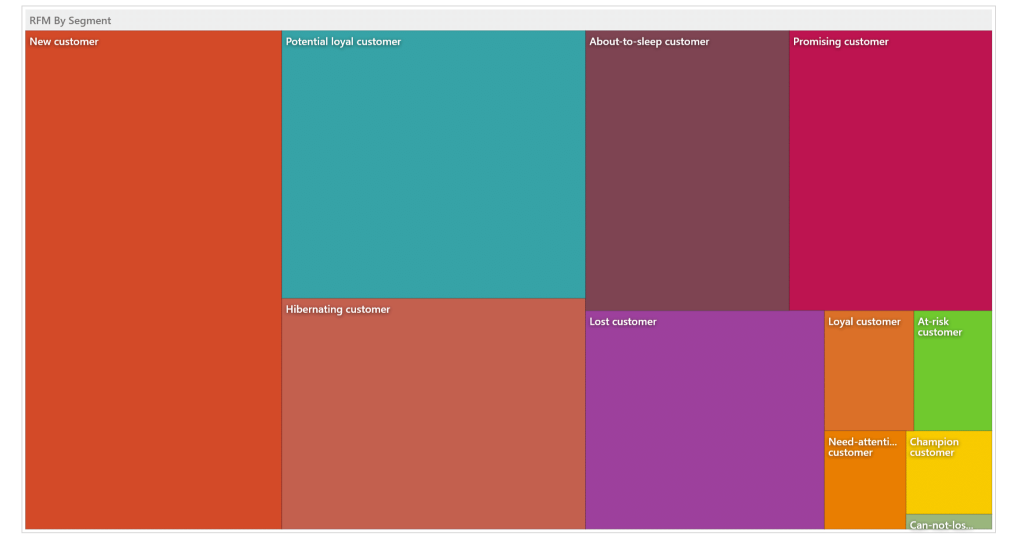

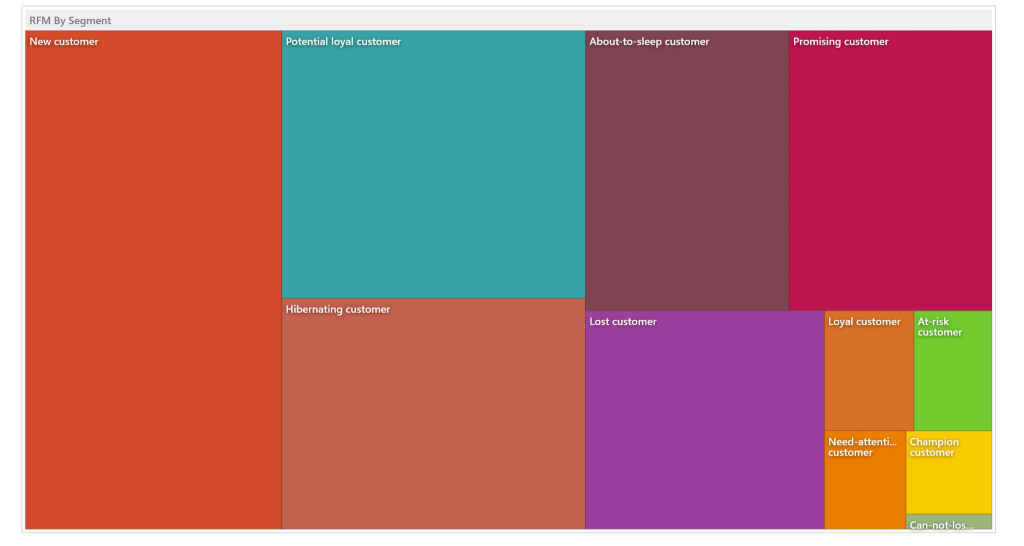

Customer Segmentation Based on RFM Analysis

Customers can be segregated into the following categories depending upon their RFM analysis scores:

- Champion Customers: These are your most valuable customers. These high value customers are frequent purchasers. They have high spending habits and recent transactions. They have a high customer lifetime value and are your big spenders and best customers for your small business. These customers keep on buying your products or services on a regular basis. They also tend to have a good spending capacity and make big purchases. They are most likely to try out your newest launches and even promote your business among their peers.

- Loyal Customers: These consistent customers contribute significantly to your revenue stream. Nurture these relationships to ensure their continued loyalty with consistent customer engagement.

- Potential Loyal Customers: This promising segment has recently engaged with your brand and spent a considerable amount. Recent customers who make repeat purchases but are not very frequent fall under this category. These customers, if cultivated well with loyalty programs, discounts, and have the potential of becoming loyalists in the future.

- New Customers: There are some customers who score high in RFM analysis but do not make regular purchases. Such ‘new entrants’ can be profitable for your business in the long run. Engage with them through various means to increase the frequency of their visits to your website. First impressions matter! Although your customer acquisition cost is typically higher than your customer retention cost, don’t forget to entice new customers towards exploring what your business has to offer.

- Promising customers.

- Need-Attention customers: Customers who used to make big and frequent purchases but have stopped doing so in recent times fall under this category.

- Hibernating Customers or Lost Customers: These are customers who were once among your best but have shown a decline of interest over time. You must communicate with them to understand their change of heart and make every effort you can to win them back.

Conclusion

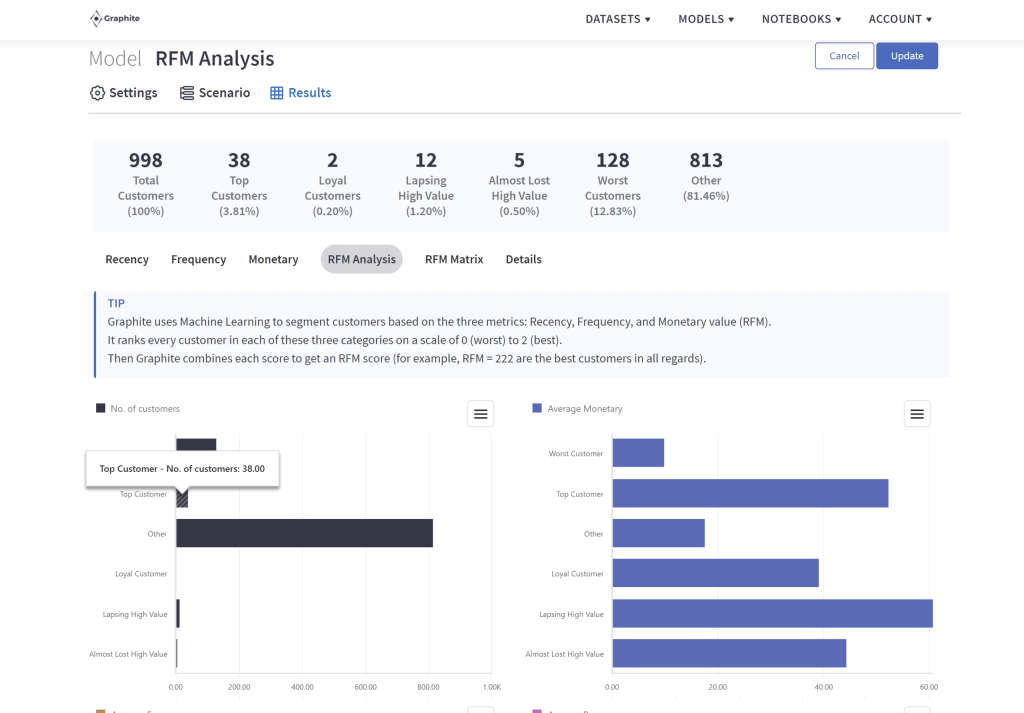

RFM analysis is an excellent way to enhance your business operations and optimize your marketing strategy. Let Graphite Note help, with no-code RFM Models built with the help of predictive analytics and machine learning to create a time-efficient, pro-tech solution for your data analysis needs.