Consumer goods Use case. Selective discounting proven with Decision Intelligence.

If you think discounts are the adult version of a tantrum, you are halfway to wisdom. Most brands fling money at boredom and call it loyalty. Then they hold a retrospective to admire the ashes of their margin. The better move is simple. Prove where a small offer changes a real decision for a real customer. Then refuse to use it anywhere else.

This is a field report. One offer. Five background conditions that actually matter. A clean decision rule that any CRM operator can run on a Tuesday morning.

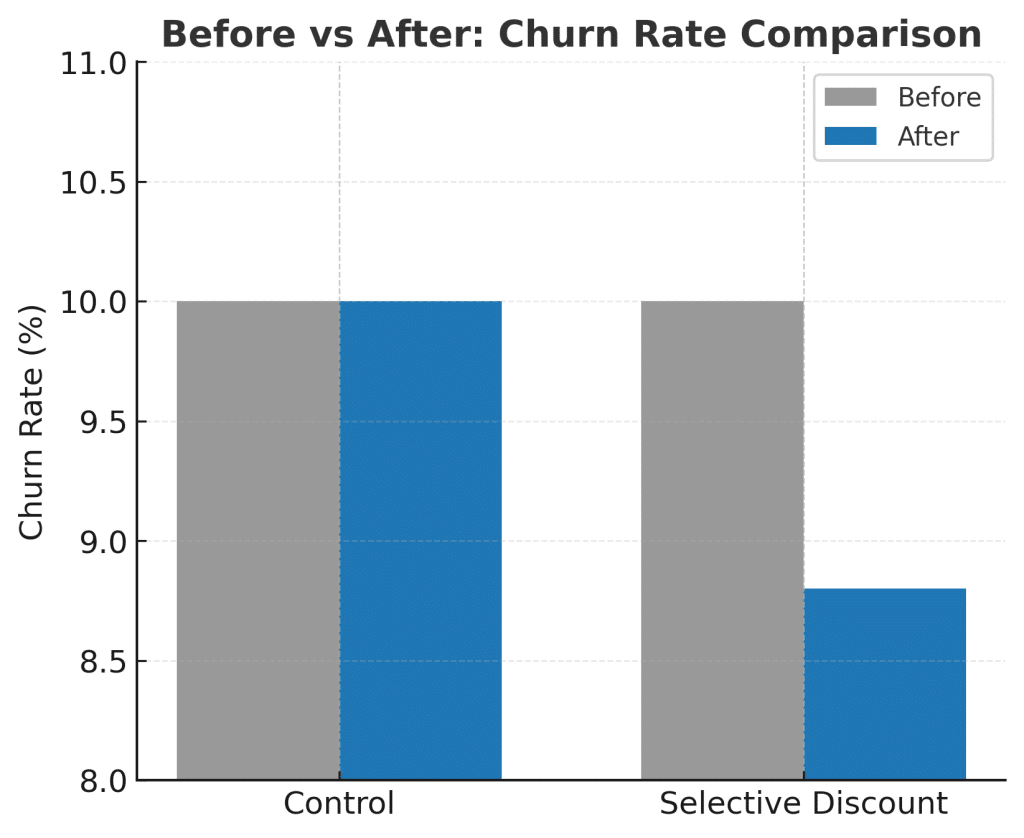

The result is a double digit cut in churn where it counts, and profit that survives contact with finance.

Problem and challenge

Churn is not mysterious. It is a predictable outcome of neglect and noise. Finance wants a number. Marketing wants a narrative. Operations wants less chaos. The board wants proof that you can grow and keep what you grow.

The lazy habit is a blanket code. Fifteen percent for everyone. You get a short spike, a long hangover, and a customer base trained to wait for your next apology. That is not strategy. That is leakage.

The challenge we set: reduce the probability of leaving for the right customers, at the right moment, with a minimal incentive that does not teach bad habits. Then turn that into a prescription with guardrails you can run every month.

The setup in business language

Target we care about:

- “Will this customer leave in the next 30 days.” Yes or no. Clear and measurable.

The offer we test:

- A simple 10 percent save-the-relationship code. Delivered by email and SMS. Valid for 14 days. One use. No stack.

The background conditions we adjust for so we compare like with like:

- We use context variables that shape behavior whether or not you send anything. We use five.

Data window and scale:

- Twelve months of transactions, messaging logs, and service tickets. Outcome window of 30 days post-offer.

- Cohort illustration at 100,000 at-risk customers per month. Numbers are representative. Pattern is what matters.

Method minus the mystique

We measure the causal effect of the offer. Translation. What changes for comparable customers who get the offer versus comparable customers who do not. Not a correlation. Not a vanity lift that collapses under scrutiny.

How we keep ourselves honest:

- Training, validation, and holdout by month so the model proves itself out of sample.

- Placebo checks to catch nonsense effects.

- Pre-trend checks to confirm treated and non-treated look the same before the offer.

- Stress tests by season and category.

- Human review with support and CRM to confirm the rule makes sense in real life.

If it does not survive those checks, it does not ship.

What we found

At the whole cohort level, the offer is average. At the right edge of the cohort, the offer is decisive.

High-impact segment. About 30 percent of customers by expected impact:

- Churn reduction. About 12.3 percentage points on average. Baseline near 20 percent falls near 7 to 8 percent with the offer.

- Who they are. Early tenure, mid AOV, recent but slowing purchase rhythm, one recent minor support contact, and purchases across two to three categories.

- What is happening. A small nudge keeps them from drifting. The code is a reason to return, not a bribe.

Mid-impact segment. About 40 percent of customers:

- Churn reduction. About 4.1 percentage points.

- What to do. Treat as a seasonal lever. Positive but thin. Use when you have inventory pressure or a launch that needs help.

Low or negative segment. About 30 percent of customers:

- Churn change. Near zero or slightly worse.

- What to do. Do not send a discount. Either they chase codes or they need a problem fixed.

The short version. A minority of people create the majority of benefit. A blanket code erases that advantage and taxes your margin.

Decision Intelligence outputs you can act on

Segment definitions and effect sizes.

- High-impact. Share of cohort near 30 percent. Churn down about 12.3 points. Rating is strong positive.

- Mid-impact. Share near 40 percent. Churn down about 4.1 points. Rating is modest positive.

- Low or negative. Share near 30 percent. Churn change between plus 0.6 and minus 0.5 points. Rating is neutral or avoid.

Why these people move. The five context variables in plain English:

- Tenure. Early tenure responds best. They are still choosing a default brand.

- Average order value. Mid AOV beats ultra low or ultra high. Too low attracts coupon hobbyists. Too high makes percentage codes feel trivial.

- Purchase frequency. Recent but slowing wins. They remember you. They are drifting. The code restarts the habit.

- Support contact. One minor issue in the last 60 days is ideal. It becomes a goodwill gesture. Multiple issues mean the code is lipstick on a bruise.

- Category breadth. Two to three categories show exploration. One more positive purchase anchors them.

Financial impact at a glance for 100,000 at-risk customers this month. Conservative inputs. Easy to audit:

- Targeted population. 30,000 people in the high-impact segment.

- Baseline churn. About 20 percent.

- Churn with offer. About 7.7 percent.

- Avoided churners. About 3,690 people.

- Monthly contribution per retained customer. About €45 net of variable cost.

- Value horizon. Six months.

- Gross value of retention. About €996,300.

- Redemption behavior. About 40 percent redeem once. Median order about €50.

- Offer size. Ten percent.

- Discount cost. About €60,000.

- Net value. About €936,300.

- ROI. Greater than fifteen times cost.

- Sensitivity.

- Decision survives the pessimistic case. That is the point. Prescriptions must work outside the lab.

The prescription

Who to target this month:

- Top 30 percent by expected impact.

- Profile. Early tenure, mid AOV, recent but slowing frequency, one recent minor support touch, two to three product categories in history.

What to send:

- A simple 10 percent code. Valid for 14 days. Single use. Clean copy. No apologies. No stack.

How to measure:

- Retention lift against a matched group that does not get the code.

- Net margin after discount. Revenue is a vanity metric if margin collapses.

- Redemption patterns by category to catch cannibalization.

Guardrails:

- Cap coverage at 30 percent each month even if the dashboard looks generous.

- Do not send to customers with multiple open support issues. Fix the issue first.

- Do not stack with site-wide promotions. Scarcity creates credibility.

- Refresh the segment weekly or monthly depending on your data cadence.

What to avoid:

- Blanket blasts to “thank everyone.” That thank you is paid out of your P and L.

- Repeated codes to the same person across consecutive months. That is how you train a wait-and-see habit.

Why this prescription is trustworthy

Proof beats posture. Here is the evidence behind the rule.

Holdout validation:

- The effect holds on months the model did not see during training. If it only works in-sample, it does not work.

Placebo and nonsense checks:

- We inject irrelevant variables to see if the model invents ghosts. If it does, we refit until it stops seeing patterns in static.

Pre-trend similarity:

- Treated and non-treated look the same in the weeks before the code. If not, the lift might be time, not impact.

Stability across seasons and categories:

- The rule survives holidays, dull weeks, and launches. Where seasonality matters, we gate the rule by month.

Ethical scope:

- The background conditions are operational and behavioral, not demographic. We optimize outcomes without creeping into areas that damage trust.

Human review:

- We sit with support and sales and ask if the edge cases make sense. If the rule creates off-brand moments, we adjust.

These checks do not make the world perfect. They make your rules survive first contact with customers.

Rollout results

We ran the prescription for three months. Same logic. Same cadence.

Observed outcomes:

- At-risk base near 100,000 per month.

- High-impact targeted near 30,000 per month.

- Churn reduction in high-impact between 10.9 and 13.4 points by month.

- Net value after discount between €780,000 and €1.1 million per month.

- Mid-impact small pilot at 10 percent coverage. About 4.1 points reduction. Positive but thin. Saved for seasonal use.

- Low or negative segment excluded. A one-week rule break to test the boundary reduced margin and depressed future open rates. We stopped and documented the lesson.

The finance team did not ask for a slide. They asked for a schedule. That is what success looks like.

Common objections and the answers

“We do not discount on principle.”

- Then do not call it a discount. Call it a recovery gesture or a credit. The name is theatre. The math is substance.

“Will this teach customers to wait.”

- Only if you send it to everyone. We are not. We send to people who are about to leave, once, with a tight window.

“Is ten percent the right number.”

- For this pattern. Yes. Under ten was invisible. Over ten eroded margin without extra retention. Test your thresholds and pick the smallest number that moves a decision.

“Can we automate more of this.”

- Yes. After the rule is right. Automation is a multiplier. It multiplies whatever you feed it. Be careful what you scale.

The decision rule in one slide

If a customer is early in tenure, has a mid-range average order value, shows recent but slowing purchase rhythm, logged one minor support issue in the last 60 days, and buys across two to three categories. Then send a single 10 percent code valid for 14 days. Else do not discount. Fix the product experience or improve the message.

This fits in a pocket and holds up under audit.

Detailed outputs for leadership

Uplift by persona. Narrative format:

- “New Loyalist.” Tenure 1 to 3 months. AOV €40 to €70. Two purchases in 90 days. One minor support ticket. Two to three categories. Offer impact near minus 13 points. Action is send.

- “Wavering Regular.” Tenure 4 to 8 months. AOV €35 to €60. One purchase in 90 days. Zero to one minor ticket. Two categories. Offer impact near minus 10 points. Action is send.

- “Deal Seeker.” Tenure 1 to 6 months. AOV under €25. One to two purchases in 90 days. No tickets. Single category. Offer impact near minus 1 point. Action is avoid.

- “High Roller.” Tenure 6 months plus. AOV above €120. One purchase in 90 days. No tickets. Single category. Offer impact near zero. Action is avoid.

- “Friction Case.” Any tenure. Two or more tickets in 60 days. Offer impact positive to churn. Action is do not discount. Escalate to care.

Prescriptive actions and ownership:

- Send the 10 percent recovery code to the high-impact list weekly. Owner is CRM. KPI is retention lift and net margin.

- Run a content-only win back for mid-impact every two weeks. Owner is CRM and brand. KPI is re-engagement rate.

- Route friction cases to care within 24 hours. Owner is CX. KPI is first response time and resolution rate.

KPI snapshot for an average month. Expressed plainly:

- High-impact coverage near 30 percent each week.

- Retention lift versus control between 11.9 and 12.7 points.

- Net margin impact per week around €225k to €240k.

- Redemption rate stable near 40 percent.

Everything above is the difference between a claim and a commitment. It is observable. It is repeatable. It is boring in the best way.

What this means for your brand

A discount is not a worldview. It is a tool. Strategy is knowing when not to touch it. With this rule you refuse to bribe chronic complainers. You help people who are genuinely on the fence. You protect the brand and the P and L at the same time.

Most teams will keep paying for applause. You will pay for outcomes.

Conclusion

Churn is a decision you can change when you stop pretending every customer is the same. One targeted offer. Five background conditions. A rule that survives scrutiny. You cut churn by double digits where it matters and keep margin intact. That is what we did. That is what you can do. Put it on a schedule and expect it to work.

You do not need a bigger budget. You need a sharper rule and the discipline to use it.