“Instead of focusing on the competition, focus on the customer.” – Scott Cook

Speculated to be introduced in a 1995 article by Jan Roelf Bult and Tom Wansbeek, RFM analysis has remained a marketer’s favorite in understanding customers.

Every marketer knows the customer is king. New-age marketers know it is imperative to sift the best from the rest.

Deviating attention from customers who matter or treating them the same as the others can endanger customer relationships. Building a loyal relationship with the best customers or converting prospects into repeat customers can be pivotal in turning any business around.

But how can you evaluate customers based on the value they bring to the company? Enter RFM analysis, a popular and verified method of customer valuation.

What is RFM Analysis?

RFM analysis is an acronym for Recency, Frequency, and Monetary Value Analysis that enables smart marketers to segregate their customer base. The technique borrows from the Pareto Principle, according to which 80% of a business’s revenue comes from 20% of its customers.

RFM analysis quantifies customers based on three key factors:

- Recency – this aspect indicates how recently the customer has engaged with a business. It includes both a current website visit to check out products/services, or a purchase.

- Frequency – this indicates how often a customer makes a purchase or visits the website to explore what’s on offer.

- Monetary Value – this is a measure of the customer’s spending capacity. This includes the average spend of a customer per visit or the overall transaction value in a given period of time.

RFM analysis helps marketers figure out:

- Customers who are loyal

- Customers who are likely to make purchases in the near future

- Customers who generate the most revenue for the business, including both old and new ones

- Customers who make periodic purchases but can be turned into loyal and repeat customers.

- One-time customers

The RFM Score

Customers are scored individually on all three aspects. The total tally is an average of all three scores. The best customers score high in each of the three specified fields and have a high RFM score.

Usually, each of the three individual scores is given equal weightage when calculating the average. But this can vary depending upon the types of business you’re engaged in.

Consider a retail business. It is common for customers to make multiple purchases in a small span of time, say a month. The transaction value of retail purchases may not be very high. In such cases, an ideal RFM score can be calculated by giving more weightage to Recency and Frequency.

Why is RFM Analysis Important?

RFM analysis helps businesses understand their customers better and engage with them in a bespoke manner. It can help you to:

- Figure out and utilize targeted communication (content + channel) for your customers

- Develop, sustain, and improve customer relationships

- Trial your product pricing

- Upsell and cross-sell across various customer categories.

In short, RFM analysis could make a tangible difference to your business in terms of profitability and customer retention.

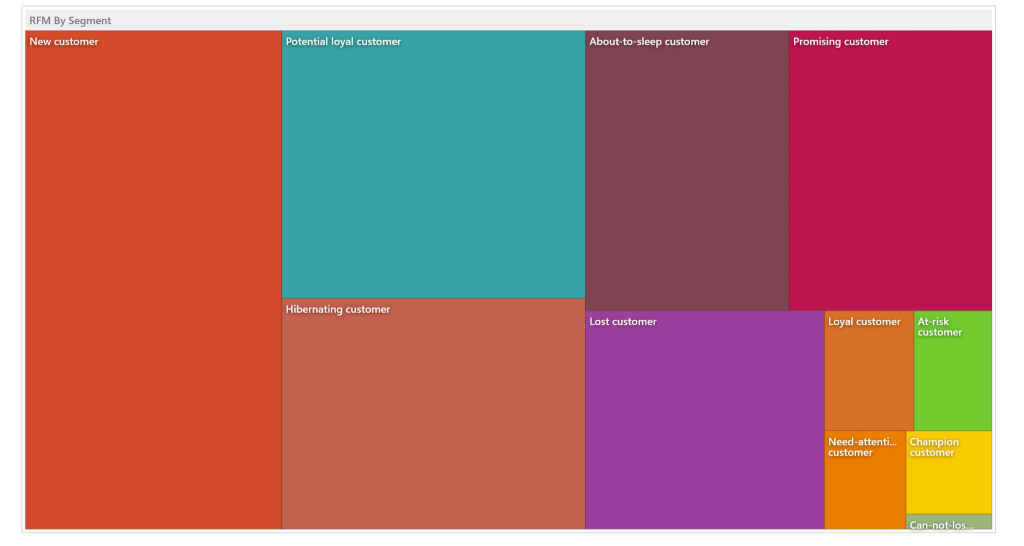

Customer Segmentation Based on RFM Analysis

Customers can be segregated into the following categories depending upon their RFM analysis scores:

Best Customers

Such customers keep on buying your products or services on a regular basis. They also tend to have a good spending capacity and make big purchases. They are most likely to try out your newest launches and even promote your business among their peers.

Prospective Loyalists

Recent customers who make repeat purchases but are not very frequent fall under this category. These customers, if cultivated well with loyalty programs, discounts, etc. have the potential of becoming loyalists in the future.

New Entrants

There are some customers who score high in RFM analysis but do not make regular purchases. Such ‘new entrants’ can be profitable for your business in the long run. Engage with them through various means to increase the frequency of their visits to your website.

Endangered Customers

Customers who used to make big and frequent purchases but have stopped doing so in recent times fall under this category.

Almost Lost Customers

These are customers who were once among your best but have shown a decline of interest over time. You must communicate with them to understand their change of heart and make every effort you can to win them back.

Conclusion

RFM analysis is a surefire way of allowing marketers to make discernible changes in their practices to help retain customers.

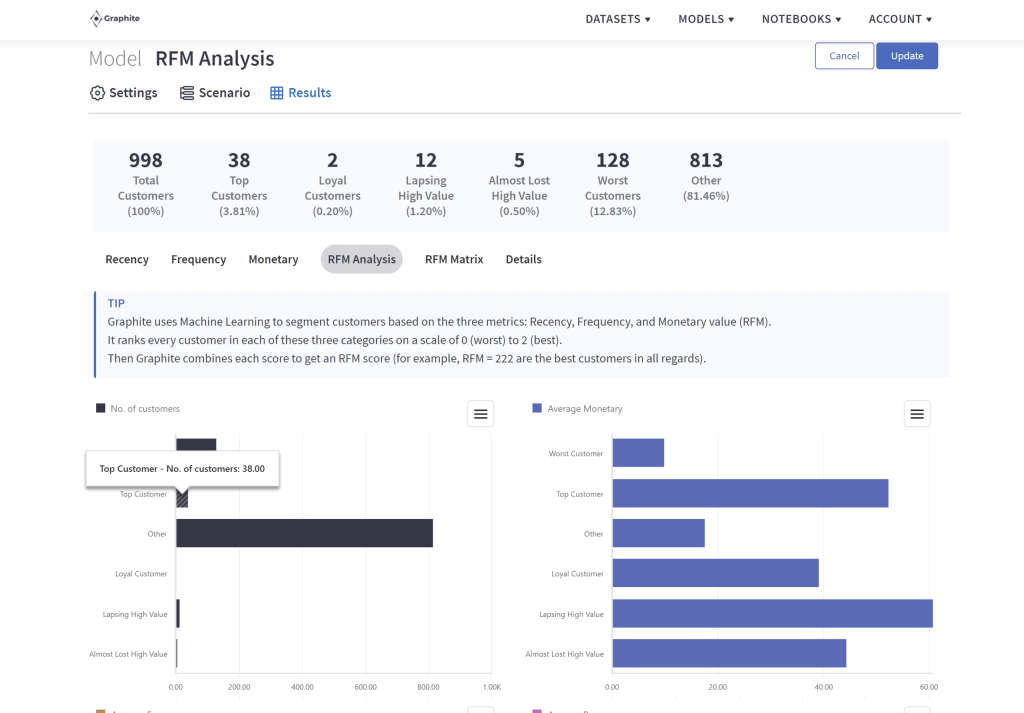

Graphite Note strives to provide such marketers with no-code RFM Models built with the help of predictive analytics to create a time-efficient, pro-tech solution to their data analysis needs.